The second stimulus bill and impact on housing

By Brad Cartier stessa.com

Diana Olick of CNBC opened up the week with some interesting real estate data to put 2020 to a close. Although mortgage applications fell 5% last week, they are still 26% higher than they were at the same time last year. Refinance volume jumped 4% as well last week and is still 124% higher than last year.

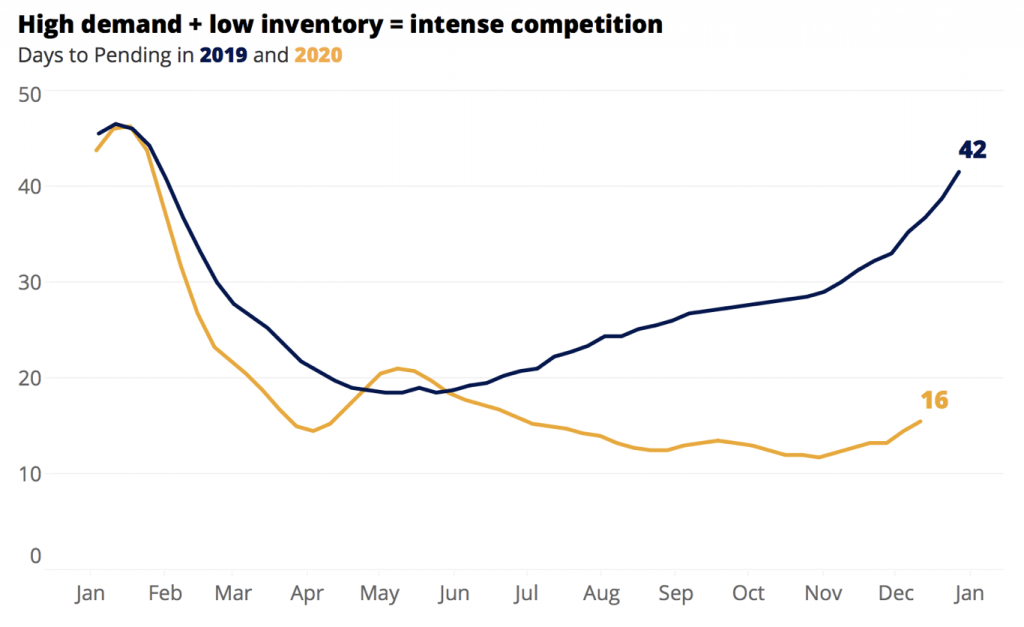

According to a report from Zillow last week, “Very tight inventory, coupled with strong demand from first-time buyers and those reassessing their housing preferences in light of the pandemic meant that the market began to move incredibly fast.”

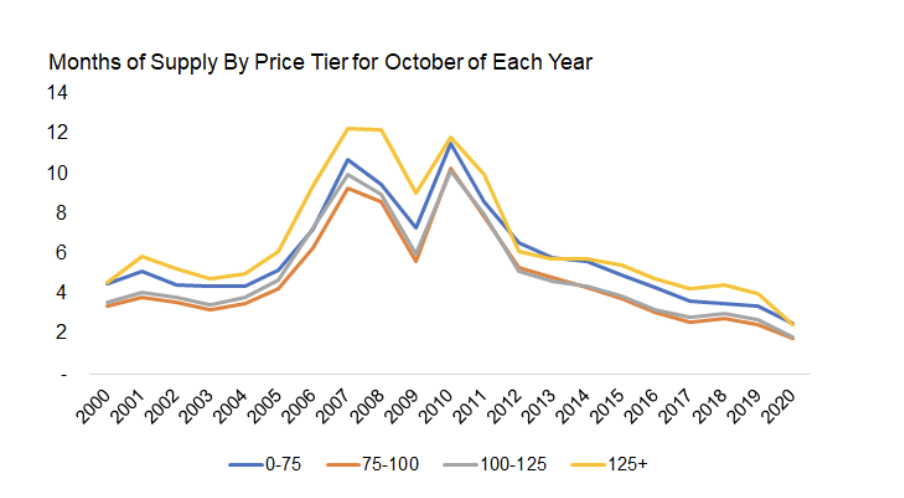

Recent data from CoreLogic suggests similar competitiveness in the housing market:

CoreLogic concludes that “for-sale inventory hit a low in 2020 as many owners postponed listing their homes and buyers were motivated by low interest rates. This inventory shortage has intensified upward pressure on home price appreciation as consumers compete for the limited number of homes on the market.”

CNBC’s Olick continues in a separate article that new home sales dropped 11% from October to November, but that sales were still up 21% year-over-year.

Finally, Alex Roha of Housing Wire reports on a holiday gift for those seeking mortgages—the lowest rates seen in the 50-year history of Freddie Mac. The average 30-year fixed-rate fell by a basis point to 2.66%, continuing its record 20 consecutive week drop.

The second stimulus bill

The second stimulus is upon us, and there are certainly some highlights worth noting for real estate investors. Dees Stribling of Bisnow (free subscription required) reports on the following key points:

Direct Payments: $300 added to weekly unemployment benefits through March 14, and direct payments of $600 to most Americans (increased to $2,000).

Rent Relief: The stimulus bill earmarks $25 billion for rental assistance. Households may now receive assistance for up to 15 months. Most of the funds will go to lower-income households or those who have been unemployed for 90 days or more.

Evictions: The bill includes an extension of the CDC’s eviction moratorium, to January 31, 2021.

Paycheck Protection Program (PPP): For those real estate businesses with employees, the bill includes a second round of PPP loans totalling nearly $300 billion, and boosting PPP loan amounts to 3.5x payroll.

According to Kelly Anne Smith of Forbes, for renters to qualify for the new $25 billion in rent relief, the following criteria will need to be met:

They have a household income less than 80% of their area’s median income.

One or more household members can demonstrate that they’re at risk of experiencing homelessness or housing instability due to a past due utility or rent notice, an eviction notice or living in unsafe or unhealthy living conditions.

One or more household members qualify for unemployment benefits or are experiencing financial hardship due to Covid-19.

The National Association of Realtors (NAR) noted that this new rent relief allows landlords to apply for the funds on behalf of tenants and can be applied to “payments for rent in arrears as well as utilities and other expenses related to housing.”

#LocalNews: The Bay Area and NYC

Rounding out the last newsletter of the year are two #LocalNews items that touch on the most talked-about markets of the year: San Francisco and NYC.

Zumper reported on the difficulty faced in the Bay area by citing rent data throughout 2020. The report summarizes their findings:

The San Francisco Bay Area experienced historic price decreases over the last year. As of November 2020, the median 1-bedroom price in San Francisco has decreased 22.6% from a year ago. In Oakland and San Jose, that median price has decreased 19.0% and 14.7%, respectively. Decreases have slowed somewhat in recent months compared to the Summer and Fall, but there’s no reason at this point to believe that decreases won’t continue in the short term.

That being said, as we hear of an exodus from high-priced markets such as the Bay area, Zumper notes that they have also seen a growing interest in new renters moving in.

In NYC, we are seeing similar trends. According to a recent New York Times article by Stefanos Chen titled, The Real Estate Collapse of 2020, the NYC real estate scene has rocked in 2020.

According to Chen,

By the end of the year, the median rent in Manhattan had fallen to a level not seen since 2010, and hundreds of thousands of the most vulnerable renters faced the prospect of eviction. But sales were finally picking up, especially in Brooklyn and Queens, and in the suburbs, they rose steeply before cooling off. Still, deep discounts were the norm at the high end, and new developments across the city faced serious hurdles.

Source: NYT

The bright spot for NYC is that most of the drop in rent prices are temporary according to the NYT, as missed payments and rent incentives have overall decreased the median rents. With the new stimulus and a vaccine, the hope is that the bleeding will stop.

Advertisement