63 Million Households Are Unable to Afford a $250,000 Home

BY PAUL EMRATH ON February 6, 2020

REPRINT BY PERMISSION

In January, NAHB released its new Priced-Out Estimates for 2020. A previous post discussed the often-cited estimate that a $1,000 increase in the price of a median-priced new home will price 158,857 U.S. households out of the market for the home. A second post discussed the related estimate that a quarter point increase in the mortgage rate will price out 1.3 million.

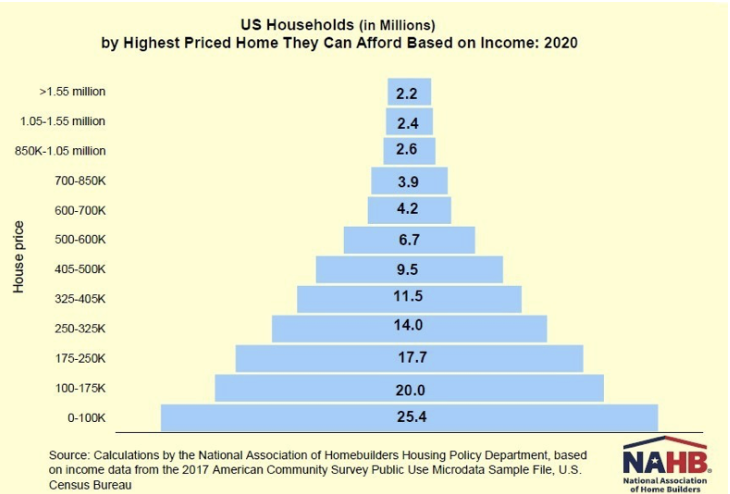

The priced-out estimates require a household income distribution along with some standard assumptions about the cost of a mortgage, property taxes and property insurance. NAHB then judges affordability by applying the conventional underwriting standard that these costs should not exceed 28 percent of household income. Among other things, the calculations can be used to count how many households have enough income to afford a home at various price thresholds. The result is a housing affordability pyramid like the one shown below:

At the base of the pyramid are 25.4 million U.S. households with insufficient incomes to be able to afford a $100,000 home. The pyramid’s second step consists of 20.0 million with enough income to afford $100,000 but not $175,000, and so on up the pyramid.

It is often interesting to look at the high end of the market—and a high end certainly exists. As the top of the pyramid shows, 7.2 million households have enough income to buy a $850,000 home, and 2.2 million even have enough for a home priced at $1,550,000. But market analysts should never focus on this to the exclusion of the wider steps that support the pyramid’s base.

Adding up the bottom three steps shows that there are 63 million households (out of a total of roughly 120 million) who are unable to afford a $250,000 home. This helps put affordability concerns into perspective and goes a long way toward explaining the result published in last September’s post, that 49 percent of home buyers are looking to by homes priced under $250,000.

For a more complete description of the methodology underpinning NAHB’s latest priced-out estimates, please consult the full study published in HousingEconomics.com.

Advertisement