People’s Bank Reports First Quarter Earnings

April 10, 2020, 6:54 PM EDT

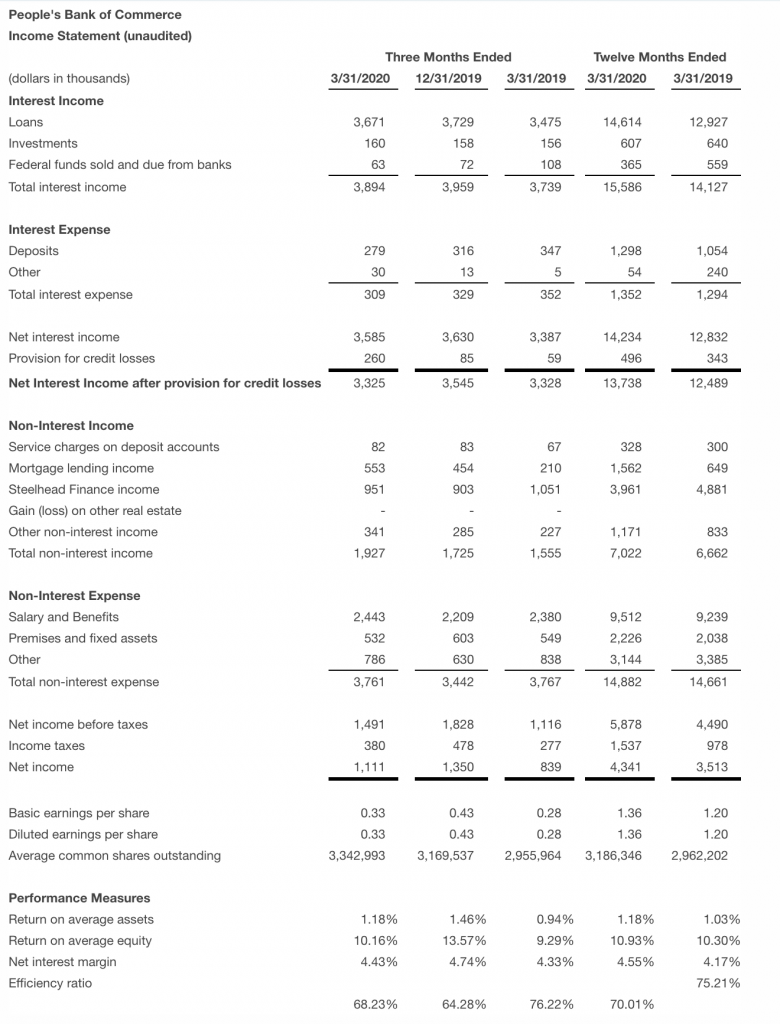

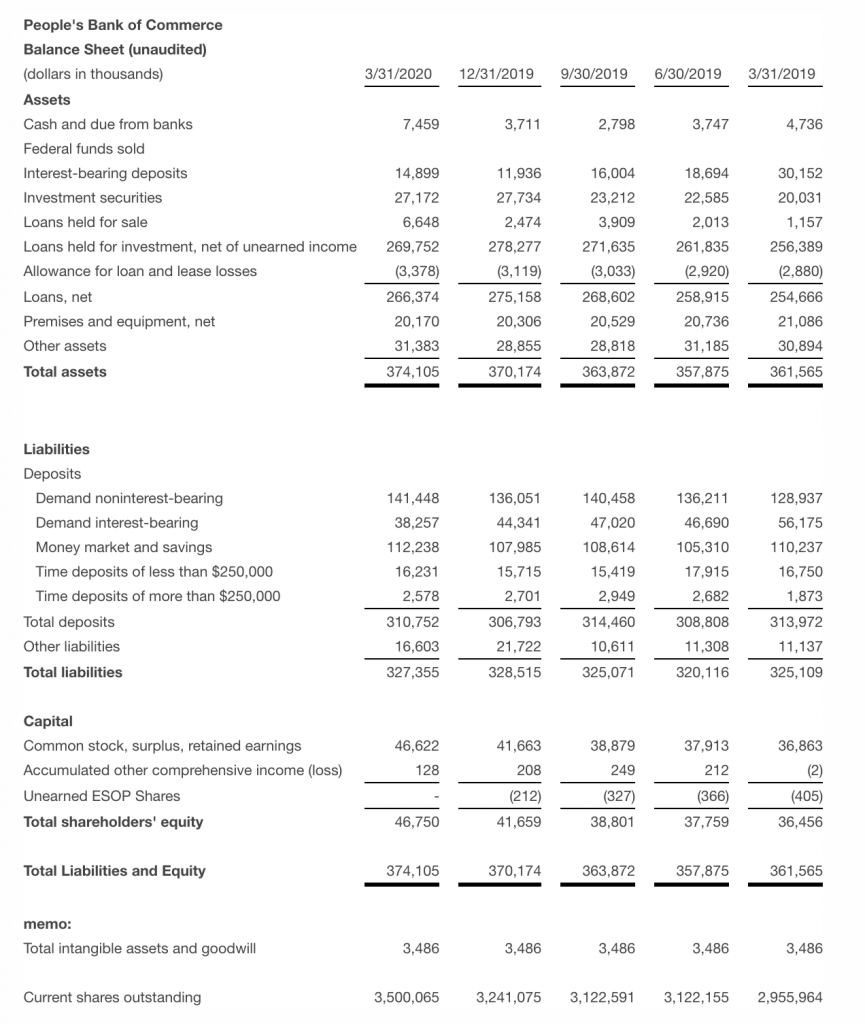

MEDFORD, Ore.– People’s Bank of Commerce (OTCBB: PBCO) announced today its financial results for the first quarter of 2020. The bank reported net income of $1,111,000 or $0.33 per diluted share for the first quarter of 2020 compared to net income of $839,000 or $0.28 per diluted share in the same quarter of 2019. Earnings per share for the trailing 12 months were $1.36 per share up from $1.20 per share the previous period, a 13% increase.

“If I had written this earning’s release a month ago, I would have focused on a very successful first quarter, with pre-tax earnings up 52% before our special COVID-19 provision”

— Ken Trautman, President and CEO, People’s Bank of Commerce

Highlights for the quarter compared to the first quarter of 2019:

- Net loans increased 5%

- Deposits decreased 1%

- The bank’s total assets increased 3%

- Net interest income, before provision, increased 6%

- Non-Interest income increased by 24%

- Non-interest expenses held flat

- Loan Loss Provision increased by $200 thousand as a buffer for the effects of COVID-19

President’s Comments

“If I had written this earning’s release a month ago, I would have focused on a very successful first quarter, with pre-tax earnings up 52% before our special COVID-19 provision,” commented Ken Trautman, President and CEO. “I would have mentioned that our strategy of diversifying income by increasing non-interest income sources was progressing along nicely. This would have been supported by the numbers; our mortgage department reporting a 163% increase in gross income and total non-interest income up 24%. Now, these results all pale to what we have accomplished in our attempt to support our customers and community during this war on COVID-19. As a Preferred Lender with SBA, we are in a unique position to react immediately to the provisions of the CARES Act, specifically the Paycheck Protection Program (PPP) component. As of April 9th, we have received funding approval for over 250 loans, totaling just under $50 million dollars, with a large pipeline of qualified, pending applicants still to be processed. Bank personnel have worked around the clock to contact customers and process applications. We are also working with businesses in our communities that are not currently our customers, helping them obtain loans, because this will affect the health and well-being of all. The SBA PPP loans, the loan modifications on existing loans and the loan deferrals we are doing will make a significant difference in the success of our community and our businesses.”

Provision for Credit Losses

“Loan quality continues to be strong with no loans past due over 30 days or on Non-Accrual at the end of the first quarter of 2020. Part of the decrease in net loans was the payoff of non-accrual loans on the bank’s books at the end of 2019. However, due to current circumstances, the bank has increased its reserve to outstanding loans from 1.12% at the end of the first quarter of 2019 to 1.25% at the end of the same quarter in 2020. The provision to increase the allowance for loan and lease losses was $260,000 in 2020 compared to $59,000 in 2019,” commented Mr. Trautman.

Non-Interest Income

Non-interest income for the first quarter of 2020 was $1,927,000 compared to $1,555,000 for the same quarter of 2019, a 24% increase. With low mortgage interest rates, the bank’s mortgage division had an outstanding quarter, contributing over $550,000 in revenue. Steelhead Finance, the bank’s factoring division, contributed over $950,000 in revenue in the first quarter.

Non-Interest Expense

Non-interest expense for the first quarter of 2020 was $3,761,000 compared to $3,767,000 for the same quarter of 2019, down less than 1%. Total personnel expense was up 3% compared to 2019, while fixed asset costs, advertising costs and supply costs were all down.

Capital

At March 31, 2020, shareholder equity totaled $46.8 million, compared to $36.5 million at March 31, 2019. This includes the successful $5 million capital raise that was completed during the quarter. The bank’s Tier 1 Capital ratio was 11.64% at the end of the first quarter 2020, compared to 9.21% one year ago. Tangible book value per share was $12.32 on March 31, 2020, compared to $11.15 on March 31, 2019.

About People’s Bank of Commerce

People’s Bank of Commerce stock trades on the over-the-counter market under the symbol PBCO. Additional information about the Bank is available in the investor section of the bank’s website at: www.peoplesbank.bank.

Founded in 1998, People’s Bank of Commerce is the only locally owned and managed community bank in Southern Oregon. People’s Bank of Commerce is a full-service, commercial bank headquartered in Medford, Oregon with branches in Medford, Ashland, Central Point, Grants Pass and Klamath Falls.

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995:

This release includes forward-looking statements intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by phrases such as People’s Bank or its management “believes,” “expects,” “anticipates,” “foresees,” “forecasts,” “estimates” or other words or phrases of similar import. Similarly, statements herein that describe People’s Bank’s business strategy, outlook, objectives, plans, intentions or goals also are forward-looking statements. All such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those in forward-looking statements.

Contacts

Ken Trautman, President and CEO

(541) 774-7654, ken@peoplesbank.bank

Advertisement