Oregon Economic Update: Not out of the Woods Yet

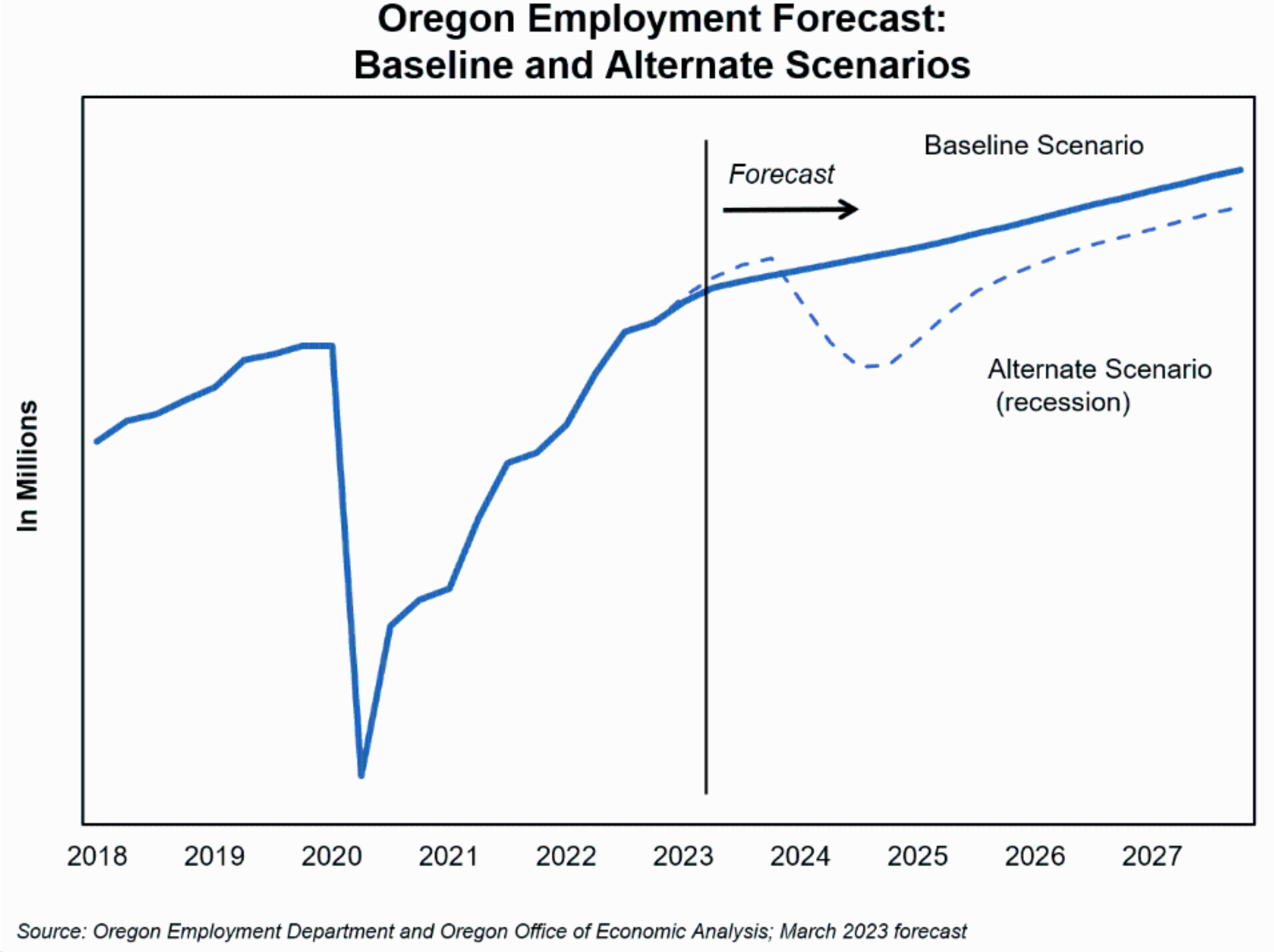

The risk of a recession, at least in the near term, has lessened in recent months as inflation has slowed. Yet inflation is still well above the Federal Reserve’s target rate, and the nation remains in the midst of an inflationary economic boom. At this point in the economic cycle, it’s unclear whether the Fed is successfully engineering a soft landing – where interest rate hikes are enough to bring down inflation without job losses – or if the lagged impacts of rate increases will tip the economy into recession further down the road. For now, the Oregon Office of Economic Analysis (OEA) believes we will avoid a recession this year but the likelihood of one in 2024 or 2025 is still uncomfortably high, according to their latest quarterly forecast.

Reasons for Optimism

The OEA lists three reasons why they believe we will avoid a recession this year:

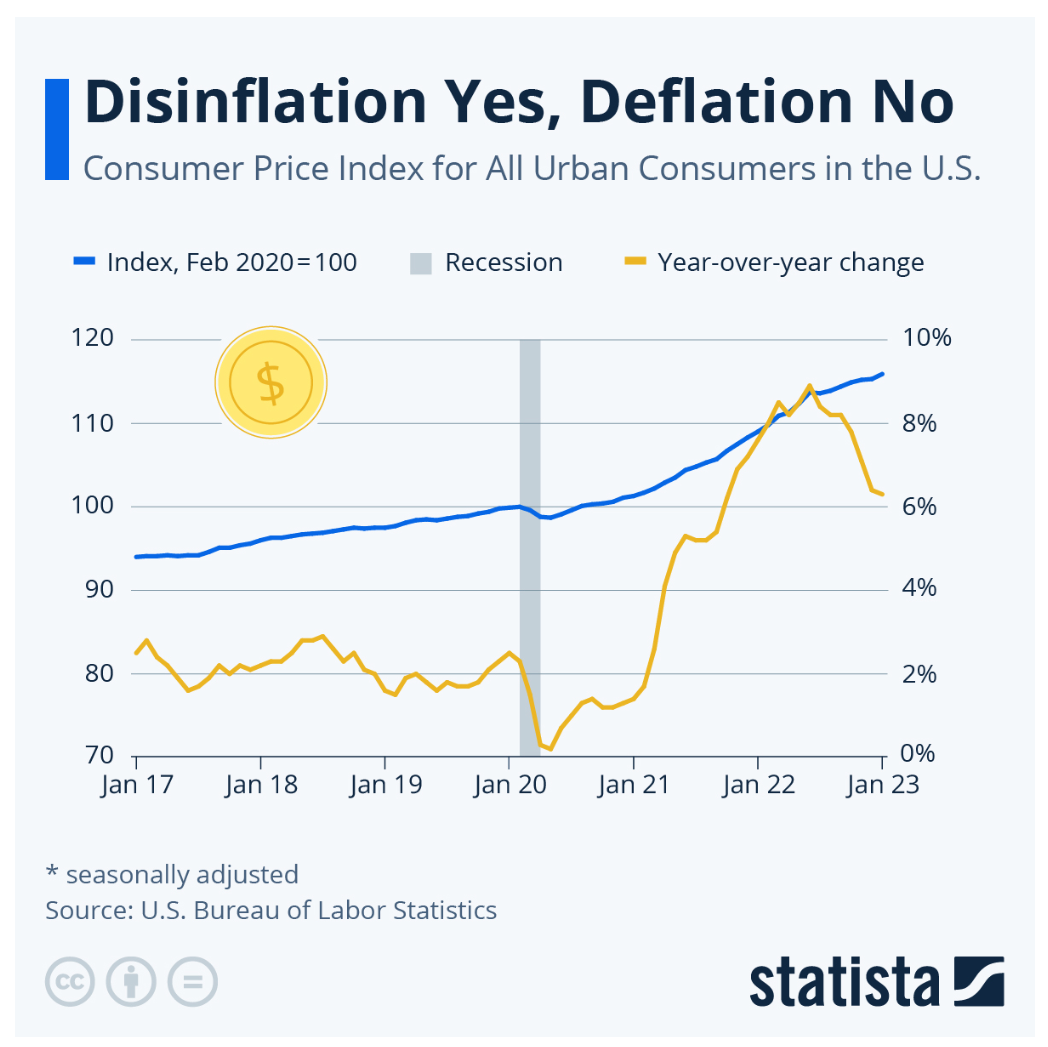

Declining inflation. Since October, the nation has seen relatively slower inflation. The U.S. Consumer Price Index is running around 5% (annualized); considerably slower than the pace throughout much of 2022. If it continues to slow, then the soft landing becomes increasingly likely. But if it starts ticking up, the Fed will need to raise rates again, possibly resulting in a recession a year or two down the road. But not this year.

Economic resilience. Consumer and business spending slowed in 2022 due in large part to rising interest rates. Home sales and new single-family housing starts plummeted, and manufacturing activity weakened towards the end of the year. We had a ‘goods recession’, as OEA calls it. Yet no major layoffs. There are several possible reasons for this, including builders and manufacturers working through backlogs, and companies holding onto employees even as sales slowed given how many firms struggled to find workers coming out of the pandemic recession (‘labor hoarding’). Or perhaps layoffs have just been delayed rather than averted. OEA is leaning towards the latter scenario, pointing to a recent rebound in consumer spending and a normalizing sales-to-inventory dynamic that bodes well for manufacturing.

Strong labor market: Initial claims for unemployment insurance in Oregon are at or near record lows for this time of year. Likewise for continuing claims, a measure of how quickly unemployed workers are able to find jobs after losing one. As of December, there were 1.5 job openings in Oregon for every unemployed worker. In other words, nearly everyone who wants a job has one.

Alternative Scenario

In normal times, forecasting is challenging. Today we are dealing with three major shocks to the economy: the pandemic, the energy price spike resulting from the war in Ukraine, and the sharpest rise in interest rates in decades. We are also dealing with a booming economy as measured by job growth, wages, spending, and unemployment. Add to this the unknown outlook for inflation, uncertainty surrounding the impact of recent rate hikes, and an increasingly cautious Federal Reserve, and forecasting beyond this year becomes nearly impossible.

That said, OEA provides an alternative scenario to the soft landing: boom/bust. In this situation, interest rate hikes (past and future) result in a recession beginning in early 2024. Between now and then, households have spent down their savings, resulting in a weaker consumer when the recession hits. This will lead to a moderate recession with more layoffs than expected. Oregon would see three quarters of job losses totaling 3%, or 60,000 jobs. Growth resumes in late 2024, and it will take six quarters to fully recover the losses.

by Amy Vander Vliet March 6, 2023

State of Oregon Employment Department

Advertisement