Lithia Reports Highest Second Quarter Net Income in Company History

Declares Dividend of $0.31 Per Share for Second Quarter

by Press Release

Lithia Motors, Inc.

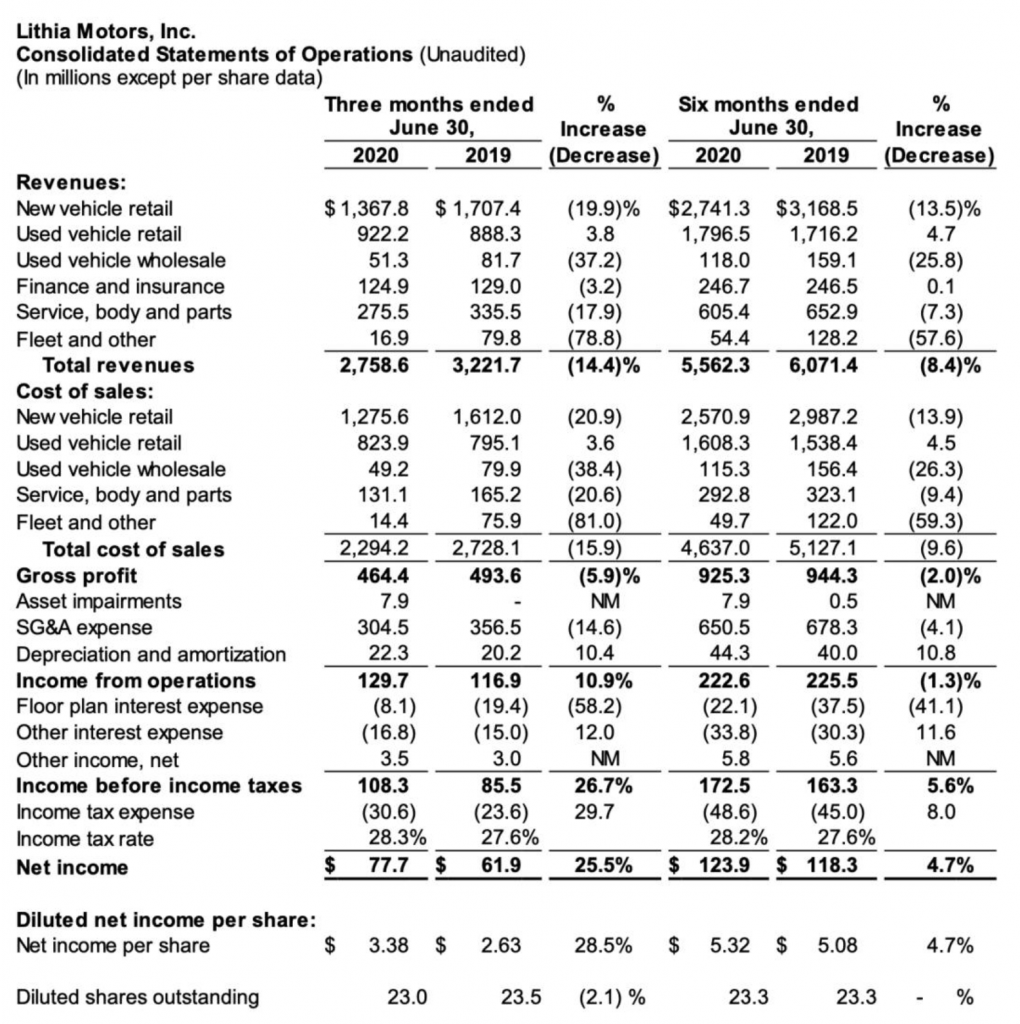

Lithia Motors, Inc. (NYSE: LAD) today reported second quarter 2020 revenue of $2.8 billion.

Second quarter 2020 net income per diluted share was $3.38, a 29% increase from $2.63 per diluted share reported in the second quarter of 2019. Adjusted second quarter 2020 net income per diluted share was $3.72, a 26% increase compared to adjusted net income of $2.95 per diluted share in the same period of 2019.

Second quarter 2020 net income was $78 million, a 26% increase compared to net income of $62 million in the same period of 2019. Adjusted second quarter 2020 net income was $86 million, a 23% increase compared to adjusted net income of $69 million for the same period of 2019.

As shown in the attached non-GAAP reconciliation tables, the 2020 second quarter adjusted results exclude a $0.34 net non-core charge related to an impairment charge, insurance reserves and acquisition expenses, partially offset by a net gain on sale of stores and a beneficial tax attribute. The 2019 second quarter adjusted results exclude a $0.32 net non-core charge due to a net loss on sale of stores, insurance reserves, and acquisition expenses.

Second Quarter-over-Quarter Operating Highlights:

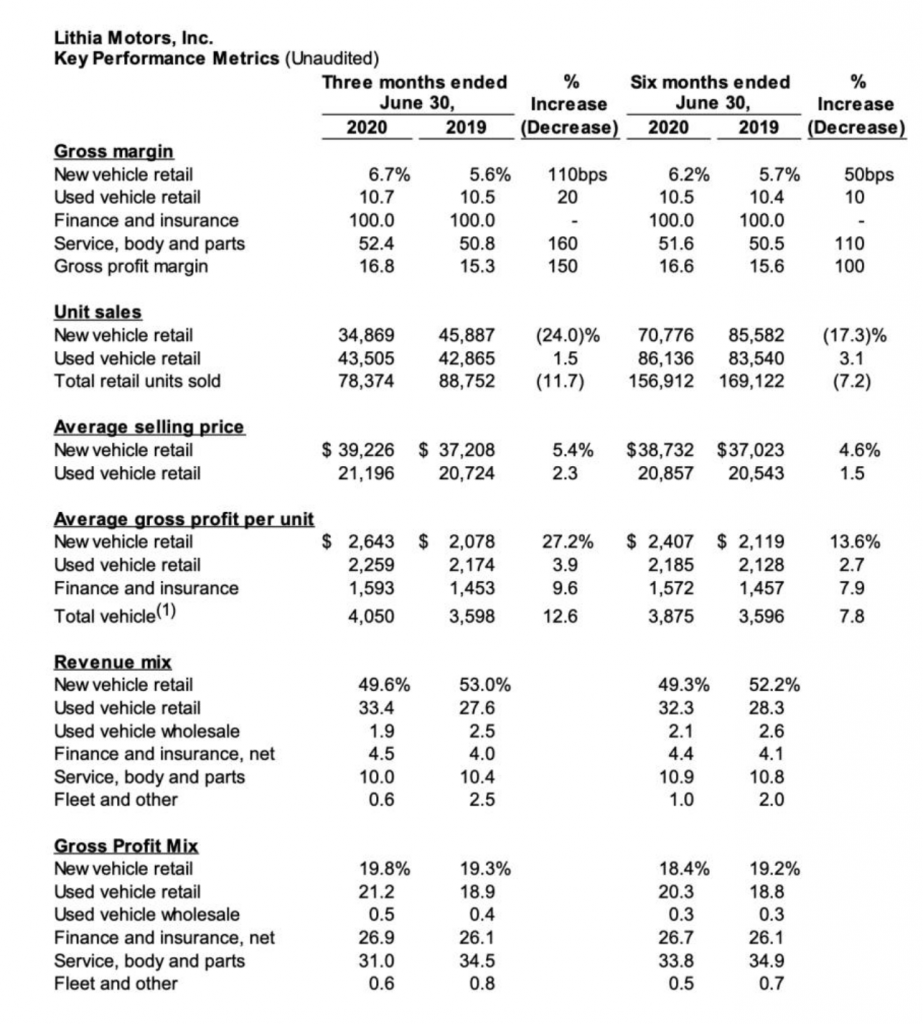

- Same store new vehicle sales decreased 23.5 %

- Same store used vehicle retail sales increased 0.5%

- Same store F&I per unit increased 9.4% to $1,590

- Same store total gross profit per unit increased 11.4% to $4,030

- SG&A as a percentage of gross profit improved 540bps to 64.7%

“The strong sequential improvements throughout the quarter, coupled with our stores’ responsiveness to the current environment, led us to the highest quarterly adjusted earnings per share in our company’s history,” said Bryan DeBoer, President and CEO. “This record performance illustrates the massive opportunity that exists within our $2 trillion industry that we are unlocking through continued growth and the activation of our ecommerce digital home solutions.”

For the first six months of 2020 revenues decreased 8% to $5.6 billion, compared to $6.1 billion in 2019.

Net income for the first six months of 2020 was $5.32 per diluted share, compared to $5.08 per diluted share in 2019, an increase of 5%. Adjusted net income per diluted share for the first six months of 2020 increased 5% to $5.70 from $5.42 in the same period of 2019.

Corporate Development

In July, they announced the acquisitions of Smolich CJDR and Nissan in Bend, Oregon and Ladin Subaru in Thousand Oaks, California. These acquisitions are anticipated to generate $160 million in annualized steady state revenues. For the year, this brings the total anticipated annualized revenue from acquired locations to $320 million and expanded our density in both the Southwest and Northwest regions.

Balance Sheet Update

They ended the second quarter with over $750 million in cash and availability on their revolving lines of credit. Earlier this month, they closed on a $255 million syndicated real estate revolving line of credit, bringing their current total cash and available credit to over $1 billion. Their unfinanced real estate could provide additional liquidity of approximately $250 million.

“The acquisition market is robust and we are accelerating the build out of our coast-to-coast network enabling us to serve customers wherever, whenever, and however they desire,” said DeBoer. “Our balance sheet is in the strongest position in our company’s history and we are well positioned to accelerate our plan to reach 5% national market share.”

Dividend Payment

The Board of Directors approved increasing their dividend to $0.31 per share.

Advertisement