Employment Report Keeps Fed On Track

By Tim Duy

DUY@UOREGON.EDU

If you were looking for something exciting out of this labor report, you were disappointed. Mostly it is is a continuation of recent trends that will encourage the Fed to retain their basic optimism while providing them no reason to change course. Probably most important for policy was the weak nominal wage growth. Absent an explosion in wage growth, it is hard to describe the labor market as overheated. At the same time, note that low inflation means that the labor market is generating real wage gains.

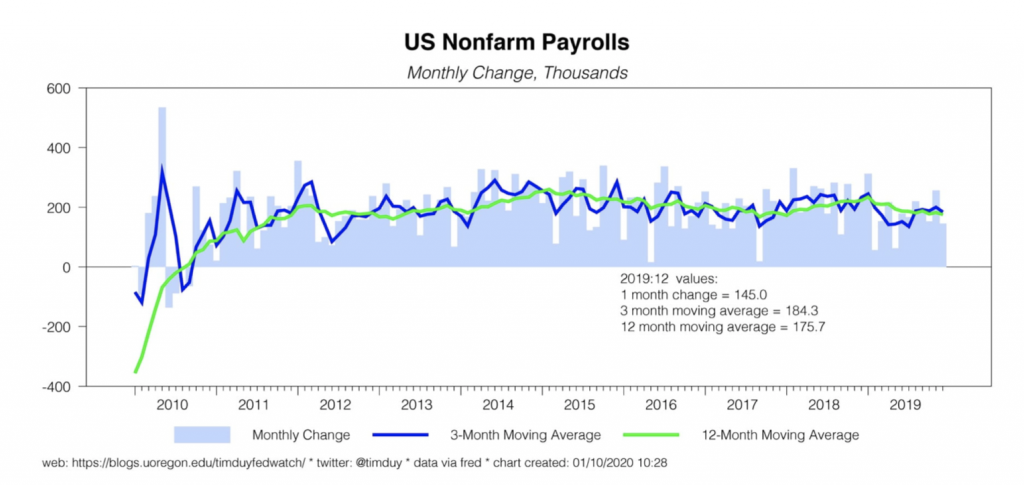

Nonfarm payrolls grew a notch below expectations at 145k:

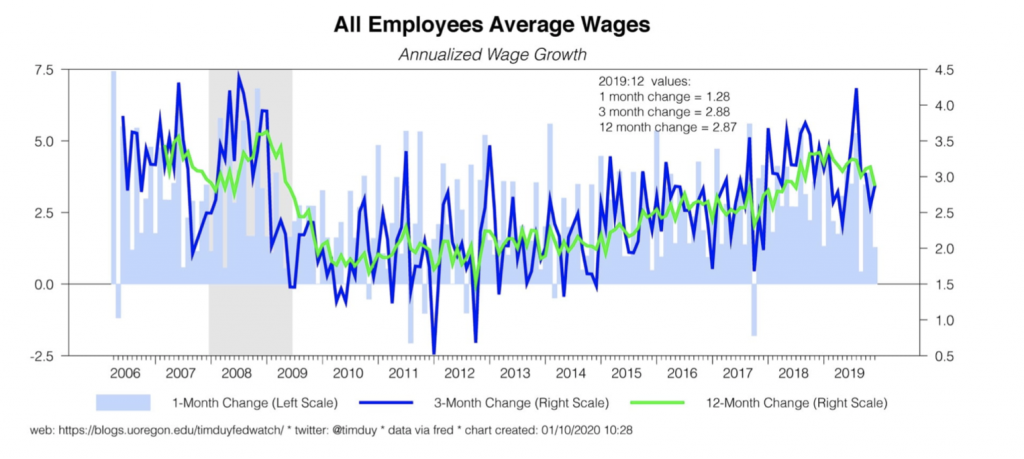

Although previous months were revised downward slightly, the average monthly gains in the final quarter of the year were a solid 184k. Still, there is a modest downtrend in the annual pace of job growth that will be more evident after annual revisions. The unemployment rate held at 3.5% while wage growth softened:

Obviously, the Fed is watching wage growth for signs the economy is overheating. And here is Federal Reserve Chair Jerome Powell from December:

“The labor market is strong, I don’t know that it’s tight because you’re not seeing wage increases,” Powell said in response to a question from Yahoo Finance on Dec. 11. “Ultimately if it’s tight, that should be reflected in higher wage increases.”

Faster wage growth does not necessarily mean inflation will accelerate, but it it difficult to expect any sustained acceleration of inflation absent faster wage growth. In other words, it is tough to get too bent out of shape about some inflationary threat with nominal wage growth crawling along around 3%. And minimal inflation worries will leave the Fed on hold; there is simply to reason to think that they need to reverse last year’s rate cuts anytime soon.

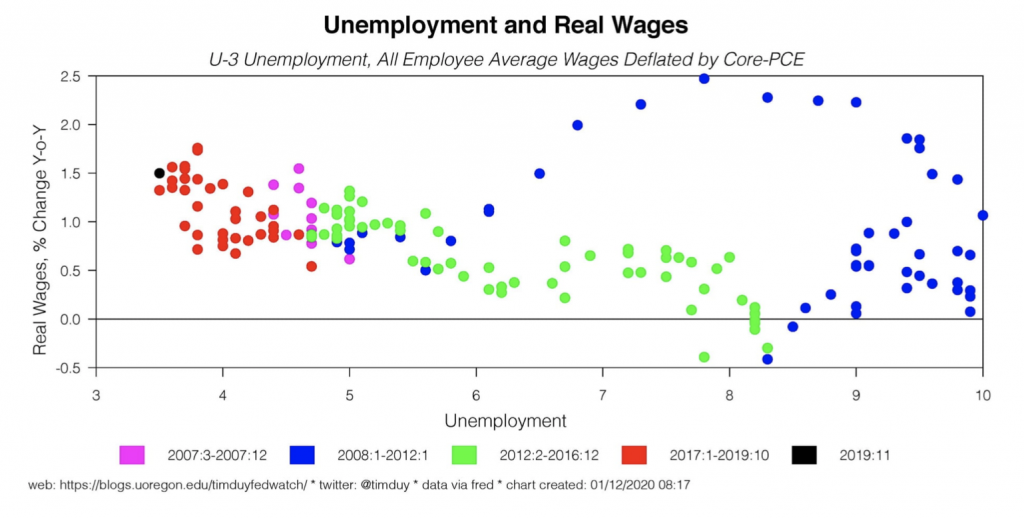

All that said, I think it is important to push back on this idea:

The weak spot – and ongoing concern – was wage growth, up just 2.9 percent over the past year. Experts say wages would have to grow between 3.5 to 4 percent in order for workers to really feel an impact.

Accounting for low inflation, the tighter labor market is now generating real wages on par or better than the pre-Great Recession boom:

I point this out to suggest that we should beware of excessive pessimism. Tighter labor markets appear to be having the intended effect of improving real wage growth, which in turn helps support consumer confidence and spending growth. Yes, I know, everything is terrible and you can never say anything good about the economy. That attitude though would have led one to sit out a multi-year equity rally as some surely have.

Bottom Line: The employment report will keep the Fed on hold. As always avoid excessive pessimism.

Advertisement