Data Beginning to Clear the Way for a Rate Cut

Central Takeaway If You Don’t Have Any Time This Morning:

The Fed hastily delivered a soothing message last week by promising to act appropriately to maintain the expansion. It was hard not to read that as dovish. That combined with the employment data puts a rate cut in play this summer.

Things That You Should Already Know About

The Trump administration announced that Mexico had agreed to help stem the flow of immigrants into the U.S. In return, the threat of tariffs has been lifted indefinitely. That said, I doubt the coast is clear entirely. I suspect that if Trump perceives this as a win, he will use this tool again.

Data

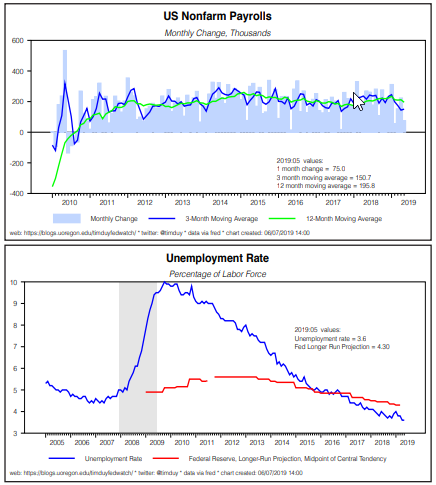

Last Friday the BLS delivered a disappointing Employment Report for May. The earlier-released ADP report guided in the right direction as the BLS estimated non-farm payroll growth at 75k compared to expectations for 180k. As if not more importantly, previous months were revised downward, dragging down the three-month average to 151k.

With these revisions it becomes more apparent that job growth has slowed markedly in the last four months. It would seem that the economy’s fiscal stimulus sugar high has worn off. But what is left behind? Sustained growth at this pace remains above the Fed’s estimates of that necessary to keep the unemployment rate steady once demographic effects take hold. The magic number is roughly 100k, so 150k might still be sufficient to put downward pressure in unemployment. That will be something the Fed will puzzle over.

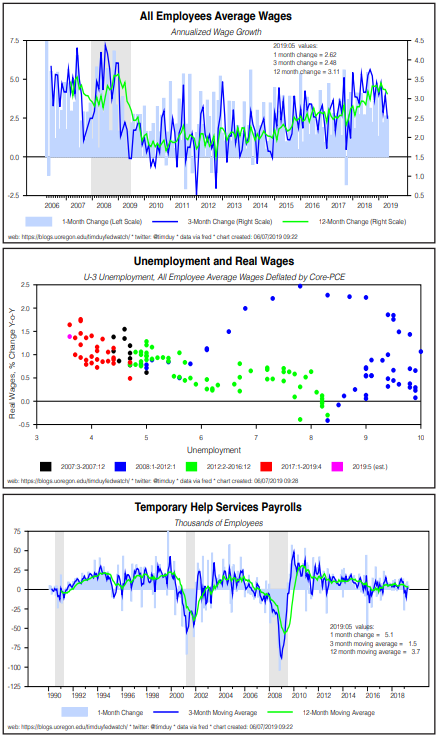

In a disappointing development, wage growth has decelerated. That said, this may not be something that should come as a complete surprise given that inflation has decelerated as well. Real wages continue to grow at a clip comparable with the immediate pre-recession period. Temporary help employment continues to grind a bit higher, but the pace is anemic. Still, temp workers are not being let go at a pace normally associated with recessions.

Fedspeak

New York Federal Reserve President John Williams, speaking before the jobs report, did not appear eager to cut rates. Via the Wall Street Journal:

“There are more uncertainties today,” he said while answering questions following remarks Thursday at the Council on Foreign Relations in New York, but “my base case is an economy that continues to grow above trend, an economy that still has a very low unemployment rate and infation moving back to 2%.”

We don’t know if the jobs report changed his view, but my guess is that Williams would see 150k job growth as generally consistent with this outlook.

Meanwhile Dallas Federal Reserve President Robert Kaplan was equally circumspect about the outlook. Regarding the risk posed by trade wars:

“Some of these decisions can change. We may see a new announcement and new decisions in the next four or fve weeks. I am concerned…But it is too soon to make a judgment about whether there is any action that would be appropriate.”

This is important; the Fed would not want to base a rate cut decision on the trade wars if peace comes in just a few weeks if those trade wars never happen.

Upcoming Data

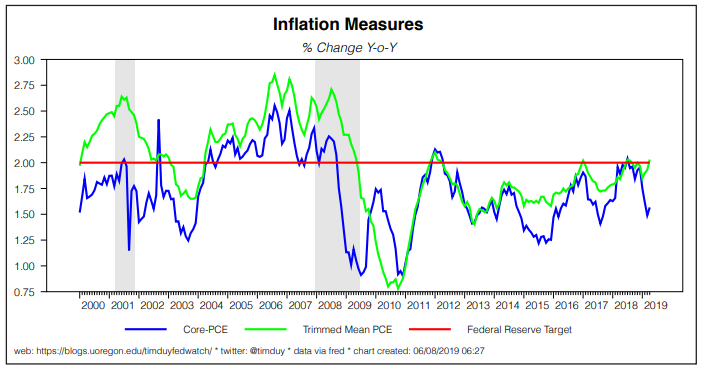

A fairly busy week ahead of us. A wide swath of price data arrives this week, with the Producer Price Index on Tuesday, the Consumer Price Index on Wednesday, and import prices on Thursday. Obviously, we will be looking for more signs to confirm or deny the Fed’s contention that the weak inflation in recent months was just transitory. Thursday we also get the usual weekly initial unemployment claims report. Friday is a big day. First, we get some insight into the consumer with the Retail Sales report; expectations are high, with Wall Street looking for headline sales to rebound 0.7% while ex-autos are up 0.4%. Following up the sales data is the Industrial Production report which is expected to be up 0.2% after a decline in April. Both reports will be watched for auto industry insight, but the basic soft trend in that sector probably won’t improve anytime soon as autos are on the downhill side of the post-recession recovery. Still, the day isn’t over then. It ends only after we see May University of Michigan Consumer Sentiment and April Business Inventories.

Blackout period for the Fed, so no Fed-speak expected. If the Fed wants to say something, it will be on deep background.

Discussion

My basic view since the beginning of the year has been that a rate cut is more likely than a rate hike. The exact timing of that move became clearer last week when Powell inserted into a non-related speech that the Fed was ready to act as appropriate to sustain the recovery. The proximate cause for those remarks were the threat of potential economic disruption from Trump’s tariff threat to Mexico. For me, that brought September into play on the basis that the Fed would require a few more months of softer data to justify a rate cut. If data worsened more quickly than expected, pull the hike forward, if not push it backward.

Events since Powell’s comments have evolved quickly. On the positive side, negotiations between the U.S. and Mexico over immigration issues yielded enough fruit that the threat of tariffs are off the table (as noted above, however, this probably won’t be the last we see of Trump and tariffs). On the negative side, the jobs report revealed a marked slowdown in job growth since the beginning of the year.

Do the two events cancel each other out? No. It is tempting to conclude that with downside risks reduced, the Powell will regret sending a dovish signal this week. I think, however, that even if this most recent tariff dispute has not occurred, the shift in the employment data would have been suffcient to put a rate cut into play. A clear slowing in economic activity by itself raises the downside risks because you don’t know when that slowing will end. Given the economy’s proximity to the lower bound, the Fed’s most likely move is to prepare for a rate cut.

The jobs report provides cover for the Fed to use the June FOMC meeting to signal a rate cut at the end of July. Why not cut in June? A number of reasons:

1. This dovish shift probably as if yet doesn’t have wide internal support. See Williams’ comments above. It will take a meeting to build that support.

2. I suspect the median FOMC participant would like to see a little more data that confirms the slowing trend in the labor market. Perhaps the June employment report reveals strong upward revisions that make them rethink the degree of slowing.

3. Worries about financial stability persist. The Fed remains wary that persistent low interest rates will set in motion the next financial crisis. Some will see the past week’s equity rally as validation of those concerns.

4. Recent inflation readings support the Fed’s contention that recent inflation weakness was in fact transitory. In the Fed’s world, unemployment remains below the natural rate, which in turn places upward pressure on inflation when inflation is already near trend. They do not have a policy of deliberately overshooting their 2 percent target. They do not know yet that the slowdown is yet sufficient to reduce the upward pressure on inflation let alone put downward pressure on inflation.

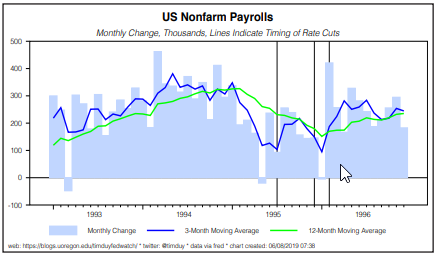

The current setup feels a lot like 1995. Then, like now, the Fed spent the first part of the year struggling with the magnitude of the economic slowdown underway. By the time of the July 1995 meeting, however, the Fed had enough evidence in hand to justify a rate cut, the first of three 25 basis point cuts. Interestingly, the employment picture shifted in the first half of 1995 as it has so far in the first half of 2019. If the Fed can engineer a repeat, 1995 would be a good model to follow as it is arguably the only instance of a soft landing for monetary policy.

To be sure, I can’t rule out a June rate cut. As I often say, when the Fed shifts gears, it shifts quickly. Still, the reasons outlined above suggest to me the path forward is to use June to signal a high probability that the next move is a cut and to deliver that cut in July (assuming of course the data continues to support that move).

Bottom Line: The Fed set a low bar for a rate cut. The data is beginning to clear the way for that cut.

TIMOTHY A. DUY

PROFESSOR OF PRACTICE

OREGON ECONOMIC FORUM, SENIOR DIRECTOR

DEPARTMENT OF ECONOMICS

UNIVERSITY OF OREGON

Professor Duy received his B.A. in Economics in 1991 from the University of Puget Sound, and his M.S. and Ph.D. in Economics in 1998 from the University of Oregon. Following graduate school, Tim worked in Washington, D.C. for the United States Department of Treasury as an economist in the International Affairs division and later with the G7 Group, a political and economic consultancy for clients in the financial industry. In the latter position, he was responsible for monitoring the activities of the Federal Reserve and currency markets. Tim returned to the University of Oregon in 2002. He is the Senior Director of the Oregon Economic Forum and the author of the University of Oregon Statewide Economic Indicators, Regional Economic Indicators, and the Central Oregon Business Index. Tim has published in the Journal of Economics and Business and is currently a member of the Oregon Governor’s Council of Economic Advisors and the State Debt Policy Advisory Commission. Tim is a prominent commentator on the Federal Reserve. MarketWatch describes his blog as “influential.” The Huffington Post identified him has one of the top 26 economists to follow on Twitter, and he is listed on Street Eye as one of the top 100 people to follow to discover finance news on Twitter. Major national and international news outlets frequently quote him, including the New York Times, the Washington Post, the Financial Times, the Wall Street Journal, and Bloomberg. He also writes a regular column for Bloomberg Prophets.

Notice: This newsletter is commentary, not investment advice.

Advertisement