Working from Home on the Decline, and Outlook for Downtowns

Working from home has been a key economic response to the pandemic. As detailed before, about 1 in 3 workers are theoretically work remotely. We know that number was higher earlier this year as working from home wasn’t so much about optimal business operations as it was to stop the spread of the virus and still get some work done. The key question remains just how large of a permanent shift we will see in the years ahead. It will increase. And recessions have a way of speeding up structural changes, but where exactly it lands is still very much to be determined.

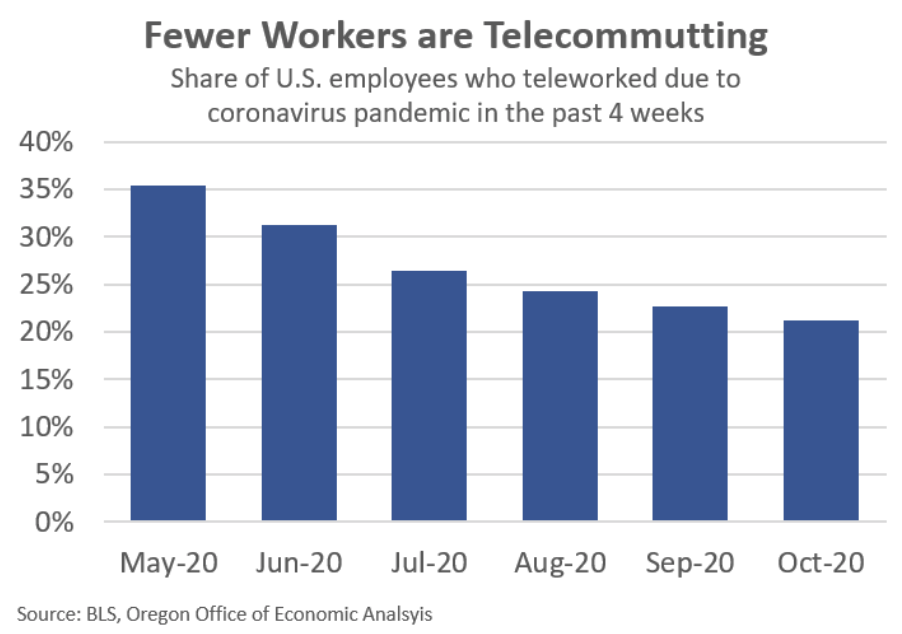

While we know working remotely wouldn’t stay at these high levels forever, even if telecommuting a day or two remains an employee perk, the question was how quickly would workers be recalled to the office? The answer it turns out is, at least to me, sooner than expected. Since May, the Bureau of Labor Statistics has been asking some supplemental questions about the virus and remote work. If you look at Americans with a job, the share who are teleworking due to the pandemic has been declining in recent months. It has fallen by more than a third, going from roughly 35% to 20% of all employees.

If you dig into the data, it shows this decline is across the entire economy. The share of workers in every industry, or in every occupational group has fallen. The overall decline is not due to compositional factors, like the fact a lot of the job growth recently is in leisure and hospitality as bars and restaurants reopened. That sort of industrial or occupational mix accounts for less than 10% of the decline, while the within industry or within occupational declines resulting in more than 90% of the overall drop in telecommuting. We’re still on track for remote work to set all sorts of records in 2020, but workers being recalled to the office is maybe happening even sooner than expected.

This issue has big implications for downtowns, or commercial centers more broadly across the country. These hubs of economic activity are reliant upon demand from local residents, yes, but also from commuters who spend the workday in the area, and also demand from being destinations for those looking to shop, eat, and partake in nightlife and entertainment. This destination demand includes both those traveling from within the regional economy and also tourists.

With the pandemic, working from home lowered the daytime demand for restaurants and shops as workers commute less. This removed one key source of sales for businesses in downtowns and commercial districts. It also means it boosted relative demand in suburban areas as the workers stayed home. Then on top of commute trends, the drop in tourism — particularly air travel — and local residents staying home more to socially distance themselves, it all hit these hubs of commerce especially hard.

Note: Other Services includes things like barbershops, nail salons, parking lot/garages, and laundry services which are more prevalent in downtowns.

So what does all of this mean? It’s still too early to know for sure. On the one hand, the fact workers are being recalled to the office in recent months bodes well for businesses in these commercial districts, leaving to the side any discussion of pubic health. It is also likely an indication that there is no massive change in business operations on a permanent basis*, or at least not yet.

On the other hand, a partial rebound in the lunch crowd, while helpful, is unlikely to keep all of these restaurants and shops afloat. At best it is a necessary, but insufficient condition for jobs centers and commercial districts to rebound. There remains key risks to the outlook for these locations and commercial real estate more broadly given the ongoing shift away from brick-and-mortar retailers and a potential drop in demand for traditional office space and high rise apartments. We know a full rebound is unlikely until the pandemic is over. At that point, people will go out to eat more, take in a concert, go on vacations, and the like.

While our office expects no real long-run damage to cities and downtowns, that doesn’t mean there won’t be issues this year and next. As City Observatory notes, there are a lot of reasons to be optimistic about cities. In the meantime our office is watching employment trends in office-based work, and tracking measures regarding working from home, dining out, and travel. To the extent there are larger, permanent changes, it provides opportunities to repurpose existing spaces to meet whatever that future demand is.

*Note that the BLS data only refers to workers who telecommute due to the virus. It does not include those working remotely not due to the virus. As such, to the extent permanent full-time remote work is already increasing, that is not captured here.

By Josh Lehner

Oregon Office of Economic Analysis

Advertisement