Where Have the Adventurers Gone? Recent Trends in Oregon Entrepreneurship

By: Henry Fields

If you’ve ever struggled to spell “entrepreneur” you might know that it’s a term borrowed from French. It’s too bad that an early English-language equivalent, “adventurer,” didn’t catch on. The term perfectly captures the swashbuckling, eccentric personality needed to start a business (and it’s easier to spell).

Though English needed the loanword, the concept requires no translation: entrepreneurship makes up an essential part of the American dream. But despite its cultural importance, entrepreneurial activity in Oregon and the nation is less common than it used to be: fewer Americans are starting a business now than a generation ago.

In this article I’ll look at several causes for this trend and try to explain what’s happening to Oregon’s entrepreneurs – or adventurers, if you prefer.

The Entrepreneur Gap in Oregon

The most recent data on business starts from Oregon is from 2014, which is a few steps behind where the economy is today. Still, as is the case nationally, we can see that the share of young firms in Oregon has declined significantly in the last few decades.

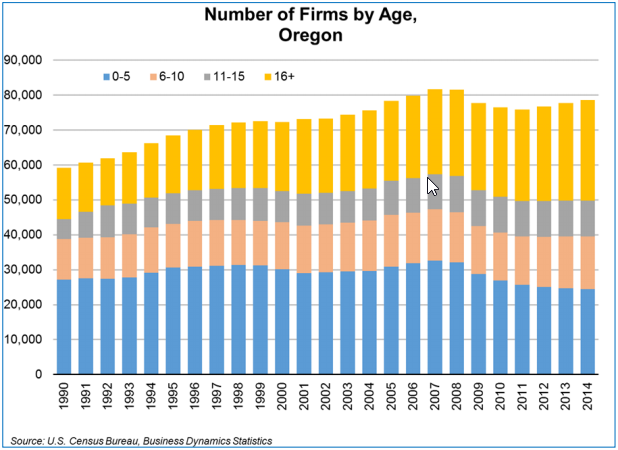

Since 1990, the percentage of startups – firms founded in the previous five years –decreased by 15 percentage points, from 46 percent of firms to 31 percent. The share of firms 11 years and older increased by the same amount, from 35 percent of firms to 50 percent.

The recession accelerated a long-term trend of declining entrepreneurship rates. In the years 2009 through 2011, during the height of the recession, the total number of firms in Oregon declined. That had a disproportionate impact on startups, as older businesses were better positioned to survive and new businesses were less likely to start during the lean years.

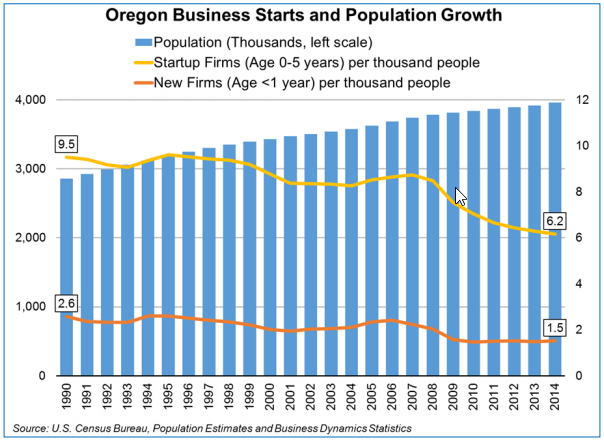

Things have started to improve since the recession, but new business formation still hasn’t kept pace with population growth in Oregon. Despite a 40 percent increase in population, fewer total companies were formed in 2014 than 25 years earlier. The number of startup firms per capita, the yellow line in the graph below, declined by one-third during this period.

Is It Just a Matter of Time?

At first glance, it might seem that a startup decline is just a temporary effect of the recession. Business formation and survival did take a big hit in the recession that, even with a long-running economic recovery, has left us with relatively few new firms.

The recession can’t explain everything, though. New firm formation from 1990 to 2008, before the recession set in, still showed a slowdown relative to population growth. In addition, Oregon saw a reduction in the percentage of workers employed at startups well before the recession, which you can see in the graph below. This trend occurred in all regions of the state.

Changing Demographics and Finances Play Their Part

Oregon’s population is aging and diversifying, as is the nation’s. These demographic trends could be impacting entrepreneurial activity.

Though Oregon is less diverse than the nation as a whole, it is diversifying more rapidly, so the barriers faced by the fastest-growing parts of Oregon’s population may be contributing to gaps in business ownership. These gaps cost the economy. Kauffman estimates that “if minorities started and owned businesses at the same rate as non-minorities do, the United States would have more than 1 million additional employer businesses adds much as an extra 9.5 million jobs in the economy, all else being equal.”

Age also affects startup rates. The two largest generations in the U.S. are the baby boomers, many of whom are reaching retirement age, and millennials, who are in their 20s and 30s.

The Portland State University Population Research Center projects that one out of four Oregonians will be age 65 and older by 2030, up from 17 percent in 2015. In general, we’d expect an aging population to negatively impact entrepreneurship – most retirees are not eager to begin a punishing new career as a business owner. However, more entrepreneurial activity is possible among retirees who live longer, healthier lives.

Young people are less likely to start a business today than in previous generations. Economic factors such as less wealth, savings, and instability caused by starting careers during the Great Recession have an impact on entrepreneurial interest. The Economic Innovation Group reported that despite high levels of admiration for entrepreneurship – nearly 80 percent of millennials consider entrepreneurs successful – young people view financial barriers as the largest impediment to opening their own business.

Would-be entrepreneurs of all ages increasingly face challenging financial conditions. The explosion of student loan debt may make debtholders more reluctant to strike out on their own. The Small Business Administration found that self-employment decreased as student debt burdens increased among young families.

Losing out on employer-provided health insurance could also make it riskier to gamble on a business venture. Research by Fairlie, Kapur, and Gates (2010) showed a statistically significant impact on entrepreneurship rates of health insurance tied to employment, observable by comparing differences between groups immediately before and after qualifying for Medicare and those with access to spousal coverage.

The Role of Structural Effects

It is possible that structural changes to the economy have driven down entrepreneurship rates, though these explanations are difficult to evaluate. Economic, regulatory or competitive pressures might make starting a business more difficult or less appealing than it used to be.

For example, the drop in entrepreneurship hasn’t been equally felt across sectors, which could have something to do with the differences in how these industries have evolved over time. Nationally, new construction, retail, and manufacturing firms per capita each dropped more than 80 percent between 1977 and 2014. New firms in services declined by only 23 percent. It may be easier to found a services business, which can easily market and contact customers through the Internet, in comparison with a brick and mortar retail store, which competes with giant online retailers, or a manufacturing facility, which requires significant capital investment.

There are many more explanations for why entrepreneurship could be lagging than I have space to go into here. In general, there doesn’t seem to be an easy answer to why Oregonians and Americans aren’t starting businesses at the rates they used to. Each of the above factors plays some role, but none explains all of the change.

Why It Matters

A lack of entrepreneurship could be concerning for the Oregon economy, even as overall employment continues to grow.

New business formation is not only a part of the American dream, but also an important element of productivity, innovation, and net job growth in the economy.

Sometimes entrepreneurs develop new business ideas that change the world. Tech companies like Facebook and Apple have reached the heights of the global economy from starts in dorm rooms and garages.

Not every entrepreneur fundamentally changes the economy. More often, entrepreneurship promotes local economic vitality and stability by building companies that are invested in, and products of, the community. Local ownership and innovation are an important ingredient for a healthy regional economy in an economically uncertain world.

In other words, to promote economic growth and local dynamism, it looks like Oregon could use a few more adventurers.

Advertisement