Unwrapping Holiday Hiring

by Anna Johnson

Retailers and package delivery companies rely on the holiday season to provide an end-of-year boost in sales that makes operating during the rest of the year worthwhile. Some businesses hire extra workers, often on a temporary basis, to get them through this busy time of year. In 2018, the number of jobs added by “holiday hiring” industries with strong holiday employment patterns was lower than average. The season’s traditional holiday buildup was smaller than usual among retailers. The new leaders in holiday hiring are couriers and messengers (UPS, FedEx, etc.), postal services, and health and personal care stores.

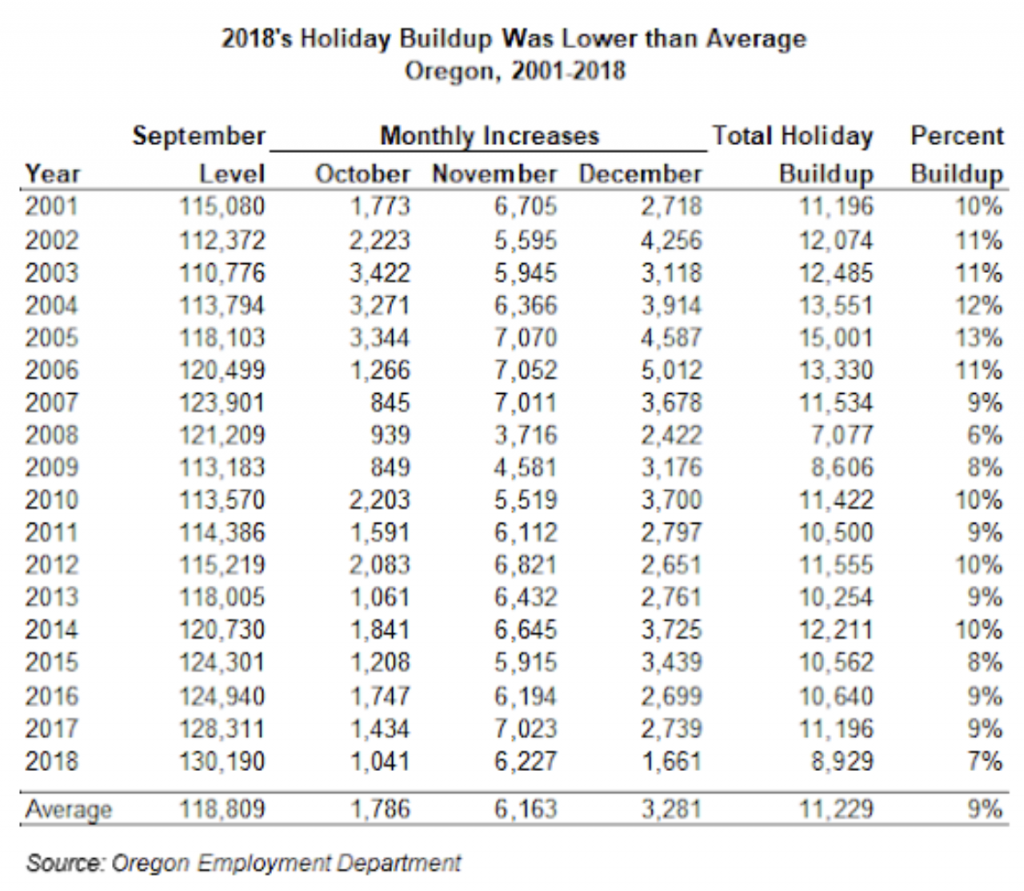

The 2018 Holiday Buildup

Oregon’s job buildup in industries with strong holiday employment patterns was 8,929 (or 7%) in 2018, which was lower than the average buildup of more than 11,200 (9%) since 2001. The “holiday buildup” is one way to measure holiday hiring activity. The holiday buildup table shows the net job gain in industries where employment grows during the holiday season and is cut soon after the New Year. Holiday buildups since 2001 ranged from a high of about 15,000 (13%) in 2005 to a financial crisis-induced low of less than half that in 2008. The October through December jobs buildup in the holiday hiring industries that year fell to 7,077, just 6 percent more than September’s level and far below the historical average buildup of 9 percent. Holiday hiring in 2018 was close to the lows seen in 2008 and 2009.

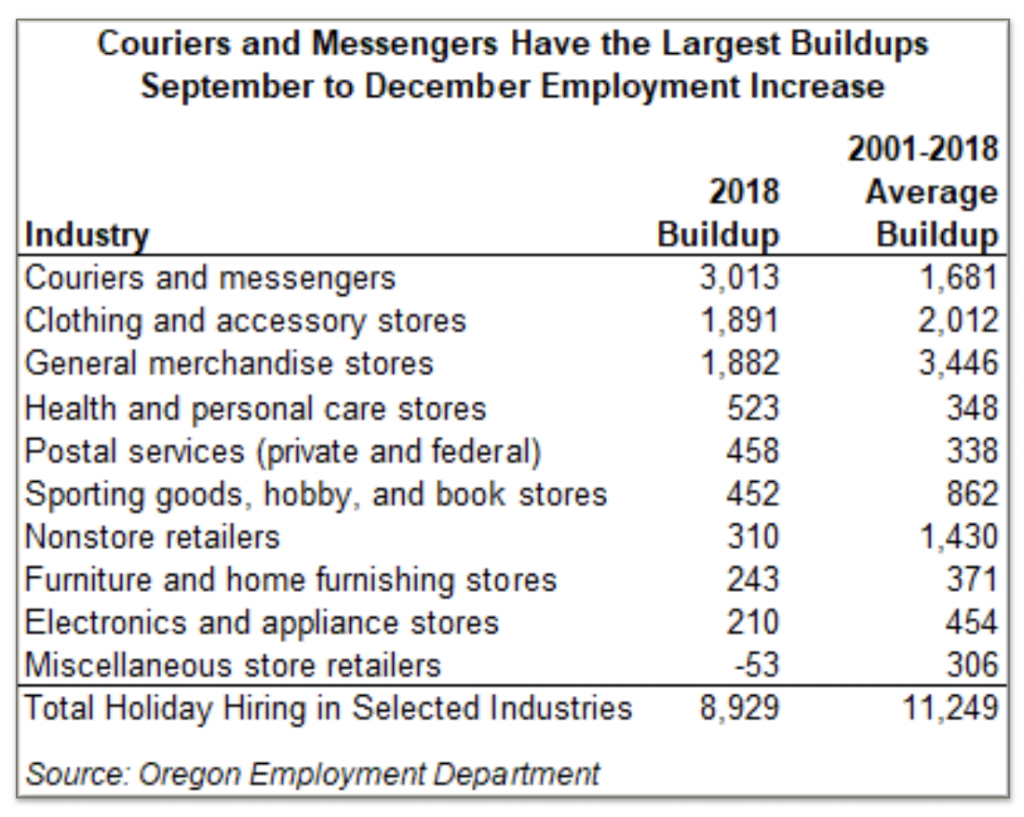

Couriers and Messengers Deliver Largest Holiday Buildup

Couriers and messengers had the largest buildup, adding 3,013 jobs in the closing months of 2018. Other industries with a large buildup included clothing and accessory stores (1,891), general merchandise stores (1,882 jobs), and health and personal care stores (523).

Increased online shopping means more jobs are being added in transportation industries during the holidays than in the past. It also means traditional retailers are increasing the number of temporary workers in their distribution and fulfillment centers that serve online customers. In-store workers will also be fulfilling online purchases using merchandise from stores, so the line between serving online customers and in-store customers is blurring.

Postal services and couriers and messengers deliver many of the packages purchased during the holiday season. Their holiday workers account for about 34 percent of the total holiday jobs buildup.

The private-sector couriers and messengers industry had the fastest buildup rate of these seasonal industries. The industry had almost twice the buildup in 2018’s holiday season (3,013 jobs) than the average buildup between 2001 and 2018 (1,681). Other industries with the fastest buildup rates were clothing and clothing accessory stores and private-sector and federal postal services. Clothing and clothing accessory stores added 1,891 jobs in 2018. Private-sector and federal postal services added 458 jobs in 2018, faster than the average of 338 jobs.

The U.S. Postal Service used to add more than 500 jobs in Oregon each holiday season. That number fell drastically starting in 2007, but has since recovered and returned to adding more than 400 jobs during the holiday season.

Bricks to Clicks

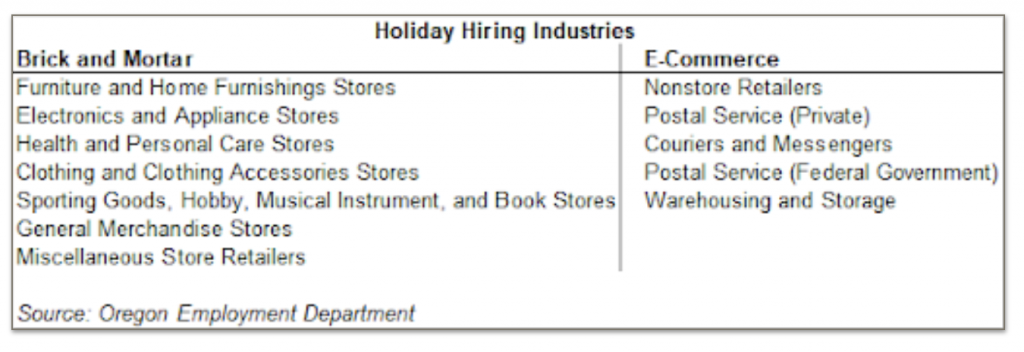

The data above can seem a little scary. Are we heading towards the next recession? Are employers having so much trouble finding workers during a time of low unemployment that hiring has slowed? It is possible, and these two factors could both be happening and impacting holiday hiring together. However, slow holiday hiring could also be attributed to the changing nature of retail. The holiday hiring retail industries included in this article are based on the March 2009 Bureau of Labor Statistics article Holiday Season Hiring in Retail Trade, with jobs at postal services (both private and federal) and couriers and messengers added to give a more complete picture of industries with strong holiday hiring patterns.

In the past 10 years, technology has advanced quickly and online shopping has expanded, impacting the economy greatly. Everything from groceries to holiday presents can be ordered online and delivered within days, if not hours. It is highly possible that because more people are doing their shopping online, traditional “brick and mortar” retailers do not need to hire as much as they did in previous holiday seasons and industries more closely related with “e-commerce” are hiring more workers.

To analyze this, the traditional holiday hiring industries can be divided between brick and mortar industries and e-commerce industries, and a sector that has been booming in Oregon recently, warehousing and storage, can be added to the e-commerce mix. Industries in the warehousing and storage subsector are primarily engaged in operating warehousing and storage facilities for general merchandise, refrigerated goods, and other warehouse products. These establishments provide facilities to store goods.

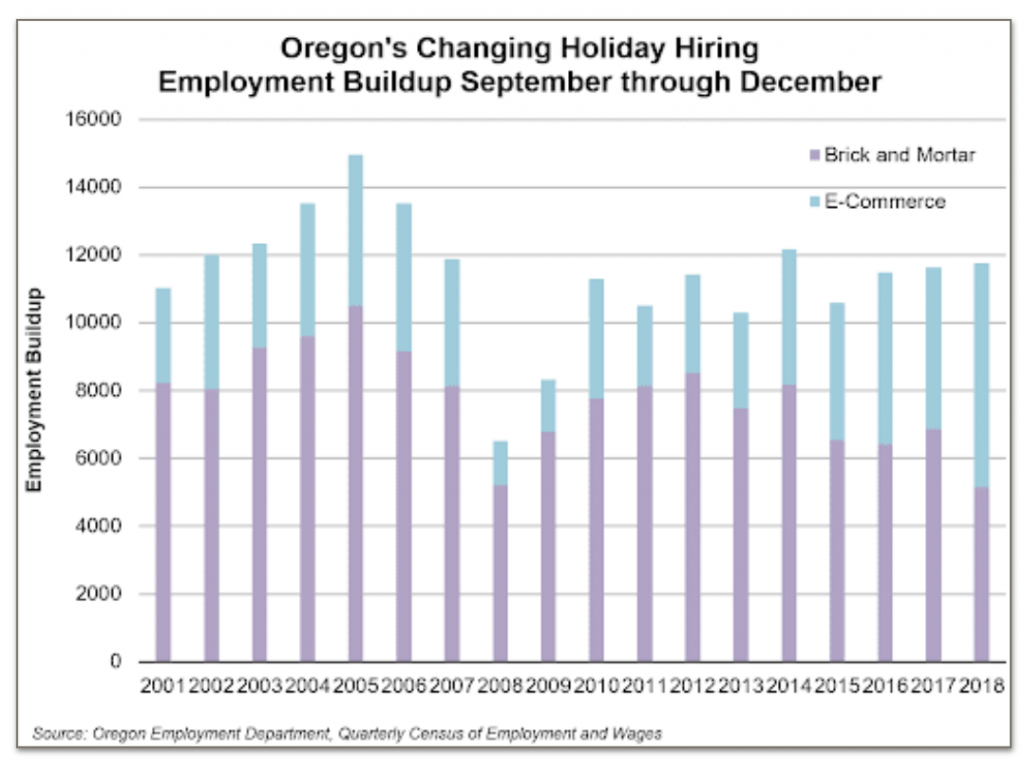

When the warehousing and storage sector is added, the picture of holiday hiring looks completely different. In total, holiday hiring (the buildup of employment between September and December) looks steady from 2010 (post Great Recession) on, with holiday hires ranging from 10,298 in 2013 to 12,180 in 2014. What is really changing is the percentage of holiday hiring that falls in the brick and mortar areas as compared with the e-commerce areas. In 2001, 74.7 percent of holiday hiring took place in the sectors found in the brick and mortar category and by 2010, it represented 68.9 percent. However, in 2018 traditional brick and mortar holiday hiring represented only 43.8 percent, while e-commerce hiring had grown to 56.2 percent of all holiday hiring. Holiday hiring is still happening at similar levels as before, it just appears to be happening in different sectors.

2019’s Wish List

Holiday buildups inevitably lead to corresponding post-holiday declines in the number of workers needed as businesses adjust back to the usual sales pace. As a group, the holiday hiring industries are growing slower than the overall economy. This suggests that not all of the jobs added in the 2019 holiday season will stick around in 2020.

It’s difficult to know what future seasonal hiring patterns of retailers will be as consumers make more of their purchases online. Parcel deliverers will no doubt continue hiring holiday workers to deliver those extra packages to all the good kids, but local stores may not need to hire as many holiday workers as in past years if their customers are doing less shopping in person. However, traditional brick and mortar retailers may be offering more online shopping options in the future and may still require more workers during the holidays, just in different occupations. As more online shopping takes place, warehousing and storage will continue to be important in holiday hiring.

We won’t know how this season’s holiday hiring compares with prior years until sometime in the New Year, but a peek at the employment forecast provides a hint about what the future will bring. The September 2019 employment forecast from the Oregon Office of Economic Analysis (OEA) expects Oregon’s retail trade employment to grow in the fourth quarter of 2019 by just 400 jobs. OEA expects the transportation, warehousing, and utilities industry to remain unchanged in the fourth quarter of 2019. These forecasts are for the entire retail trade sector and much more than warehousing and storage in the transportation, warehousing, and utilities industry, not just the industries with a lot of holiday hiring, but the implication is that the holiday buildup will be below average this year in these areas.

Advertisement