Rising Unemployment Insurance Claims Portent to Economy-Wide Job Losses

by Guy Tauer

April 13, 2020

Oregon workers who have lost their jobs, been temporarily laid off, or had hours drastically reduced filed 269,900 initial unemployment insurance claims in the three-week period ending on April 4, 2020. This is a truly staggering and unprecedented increase in demand for unemployment insurance benefits and a taxing toll on the systems and processes in place to handle claims activity. Know that the Oregon Employment Department is marshalling resources as quickly as possible to rise to this level of need.

After bolstering our workforce and realigning resources to meet this demand, we processed 10,000 unemployment insurance claims in one day recently. Our hearts are with all of those who have lost their jobs or are on temporary layoff, and especially those who have been touched by the coronavirus pandemic directly.

The nation also saw record unemployment insurance claims activity during the past couple of weeks, with about 6.6 million initial claims recorded in the country during the past week ending April 4, 2020. While the national March payroll employment figures were just released showing a decline of 700,000 payroll jobs, the true toll of the recent spike in unemployment claims and job reductions won’t show up in earnest until the April monthly employment and labor force data are released. For Oregon’s counties, that will be in late May.

An early look at what industries are likely to see job losses reported in next month’s employment data might be seen in unemployment insurance claims filed by industry and county. This is far from a perfect yardstick to measure overall economic or employment impact for a number of reasons. We have industry and county detail for 117,100 claims that were processed in the three weeks ending April 4, 2020. Of course, many workers that were impacted may not file for unemployment or be eligible. Or they could have had difficulty accessing overwhelmed phone lines if they were not able to complete their application online. This is administrative information, and while not perfect way to calculate the impact, some general inferences can be drawn. This event has no precedent or roadmap from which to draw conclusions about medium- or long-term effects. The scale and breadth of industries that are showing this rapid rise in unemployment insurance claims is also unsettling.

Rogue Valley Initial Claims for Unemployment Insurance

The Rogue Valley accounted for about 7 percent of the roughly 117,100 initial unemployment claims filed in the three-week period ending April 4, 2020. In other words, we have industry detail regarding almost 8,200 initial claims filed in the Rogue Valley, but these are just a portion of ALL claims filed during that time.

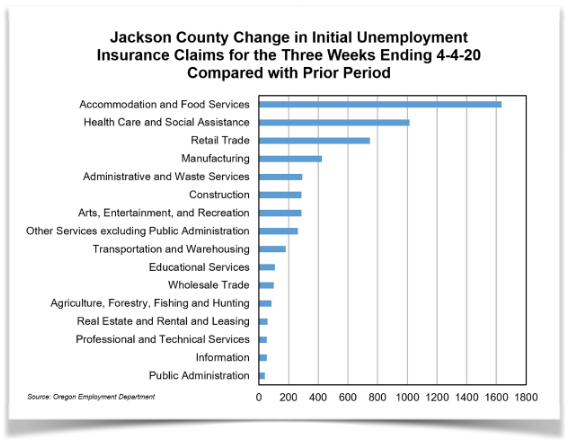

In Jackson County during the three week period ending on April 4, 2020, there were 6,257 claims processed. Compare that to the prior three-week period ending March 14, when 588 initial unemployment insurance claims were processed. Josephine County saw a similar spike, with claims over the same time periods rising from 229 to 1,937. Looking at the change in initial claims filed from the most recent three-week period compared with the prior three-week period in Jackson County, the largest jump in the area was, as you would expect, in the accommodation and food services industry, rising by more than 1,600.

The second largest jump in initial claims processed was in the health care and social assistance industry, with more than 1,000 additional claims processed in the most recent three-week period than the one before. In past swings in the business cycle, the health care and social assistance industry has been touted for being recession resistant. During the Great Recession, the longer-term growth trend in that industry just slowed slightly before continuing to expand. But in this sudden economic contraction, we have seen even that industry impacted by reduced activity, as non-urgent medical and dental procedures as well as other elective medical care have been postponed.

Retail trade, with many stores and retail complexes curtailing operations, saw nearly 750 more claims processed. A couple industries you might presume wouldn’t be impacted so quickly have already seen an uptick in claims – manufacturing (+426) and construction (+288).In Josephine County, the largest change was also in the accommodation and food services industry, up by 543 claims from the prior three-week period.

Health care and social assistance saw the second-highest increase, with 276 more claims filed in the three-week period ending on April 4 than the previous period. Retail trade (+160), manufacturing (+144), and construction (+91) were others among a wide range of industries seeing an uptick in initial claims for unemployment insurance. Not only have the swiftness and sheer numbers of claims filed been a seismic event in our employment history, but the early impacts across such a wide swath of industries is another trend to pay attention to.

For the time being, we will be issuing the latest data regarding weekly new unemployment insurance claims every Thursday at 10:00 a.m. and you can visit our website for more details about this information at https://www.QualityInfo.org/covid-19.

Advertisement