Oregon’s Marijuana Industry and Employment Trends

By Guy Tauer Oregon Regional Economist Coos, Curry, Jackson, and Josephine counties guy.r.tauer@oregon.gov Original posted at https://www.qualityinfo.org/-/oregon-s-marijuana-industry-and-employment-trends

Recreational marijuana sales hit a new record high of $110.5 million in April 2021, a 23.5% increase over April 2020 when sales reached $89.7 million. With sales trends going back to 2016, we see a seasonal pattern where sales tend to be lowest in February and reach their yearly peak in August. Harvest totals continued to rise despite the pandemic. Oregon’s total wet weight harvest peaks steeply in October, and reached 3,999,776 pounds in October 2020, up from 2,946,726 pounds in October 2019.

Having grown up in the heart of the so-called “Emerald Triangle” of the once entirely illicit marijuana industry, I’ve observed remarkable changes both from a legal and societal acceptance perspective in a relatively short time span. I would imagine that those who lived through the end of the alcohol prohibition era in 1933 witnessed a similar rapid change once the speakeasy gave way to legal bars, taverns and legal retail liquor sales. Oregon’s bumpy path toward legalized recreational marijuana sales may have germinated back in 1973 when the state became the first to decriminalize possession of less than one ounce of marijuana.

While not a “new” industry in the sense the seeds were sown by a new technology, product or market, rather this is an industry that has been flowing through Oregon’s economy for decades. This industry has a long-standing presence and is even more concentrated in the outdoor marijuana cultivation-friendly climate of the southwestern corner of the state, essentially for generations. The economy has been rife with cannabis activity, economic output, and income gains, mostly beneath the scope of any real data to measure that activity. The only real published figures were when law enforcement interdiction produced poundage and street-dollar value estimates of the formerly illegal seized cannabis products. Even now, federal statistics are by nature precluding any tally of employment, revenue and sales data for this budding industry sector. A few regional economies, including Oregon’s, are now pulling the curtains back on the scope of this older, but now legal industry as data on sales, revenue, and employment become available.

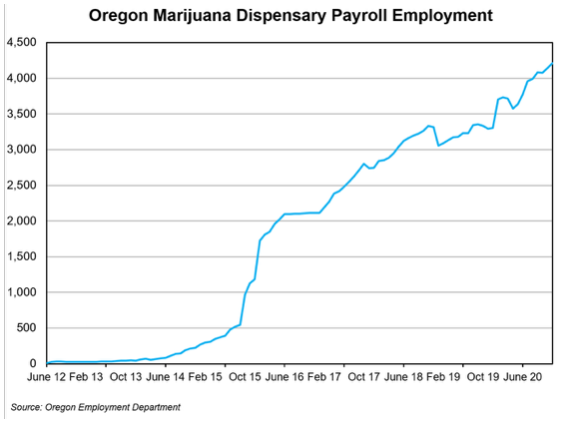

Transitioning to the Retail Dispensary Model

One of the evolving changes in Oregon’s legal marijuana industry is the shift to retail dispensaries. As of January 1, 2017 sales are allowed at licensed recreational retailers. Previously, medical marijuana dispensaries were also allowed to sell to recreational customers – any adult over 21 years old. Currently, recreational dispensaries may sell cannabis to both recreational and medical customers, with only recreational customers subject to taxes. Now medical-only dispensaries are only allowed to sell cannabis to those with a medical marijuana card.

From a business perspective, these changes have ushered out the era of medical-only dispensaries. There were only 48 strictly medical dispensaries left in the state in April 2017. By late 2018, the Oregon Health Authority/ Oregon Medical Marijuana Program database listed just five medical-only dispensary businesses remaining statewide. On the other hand, the Oregon Liquor Control Commission (OLCC), which oversees the recreational marijuana industry, listed 756 active licenses for retail dispensaries as of May 5, 2021.

In addition to licensed retail dispensaries, the OLCC also publishes license-holders, by county and firm name, for marijuana processors, wholesalers and producers. The largest number in Oregon was for producers, with 1,320 marijuana business licenses approved. There were also licensed processers (296); wholesalers (217); and testing laboratories (20), according to the OLCC business license database. Business names in this database are disclosed, but not any other data including sales or employment. The Rogue Valley in the Southwestern part of the state, also part of the “Emerald Triangle” – a prime area for marijuana cultivation – is home to almost 40% of the licensed marijuana producers in Oregon.

Using Unemployment Insurance Payroll Employment to Count Marijuana Jobs

From an employment perspective, the Oregon Employment Department has to play a bit of catch-up with these rapid changes. The Oregon Employment Department tracks employment and wages through the Unemployment Insurance (UI) program, which collects data from employers subject to UI law to produce our Quarterly Census of Employment and Wages (QCEW).

In an effort to track payroll employment at marijuana-related businesses, the Oregon Employment Department has created a database of known marijuana-related recreational and medical dispensaries. The Oregon QCEW unit designates an employer as being marijuana-related if the primary nature of the business is deemed to be marijuana-focused. This includes businesses involved in the growing, processing, and distribution of marijuana and marijuana products, and businesses that support those activities. They use a variety of methods to make this determination, including reviewing information provided by the employer, referencing industry registries like the OLCC license registry, and reading information publicly available online. But it’s not yet a perfect science. Because of marijuana still being illegal in the eyes of the federal government, some establishments are not forthcoming in proclaiming that they are selling marijuana. Dispensaries might have workers who are not counted in that industry. For example, if a dispensary uses a staffing agency to fill their job openings, those workers would be included in the professional and business services industry – where temporary help or employment placement businesses are counted. A sole proprietor with no employees covered by unemployment insurance would also be excluded from the Oregon Employment Department figures. And the sheer number of new dispensaries create additional challenges.

As of the fourth quarter of 2020 the Oregon Employment Department tallied 375 dispensaries that had jobs covered by unemployment insurance. These are establishments that are in the marijuana industry, but due to imperfect data, and factors such as sole proprietors not required to have unemployment insurance coverage, are missing from our count of cannabis industry jobs. The database of OLCC retail dispensaries with a business license was about twice as many businesses (756). Of course every OLCC-licensed business may not be in operation yet, or someone may have a license with plans to open a dispensary in the future. So it’s not an exact comparison when comparing businesses who are licensed with the OLCC and those that we are tracking in our payroll statistics information. Despite the differences, it’s safe to say there are far many more working at Oregon dispensaries than we are capturing in our payroll employment data.

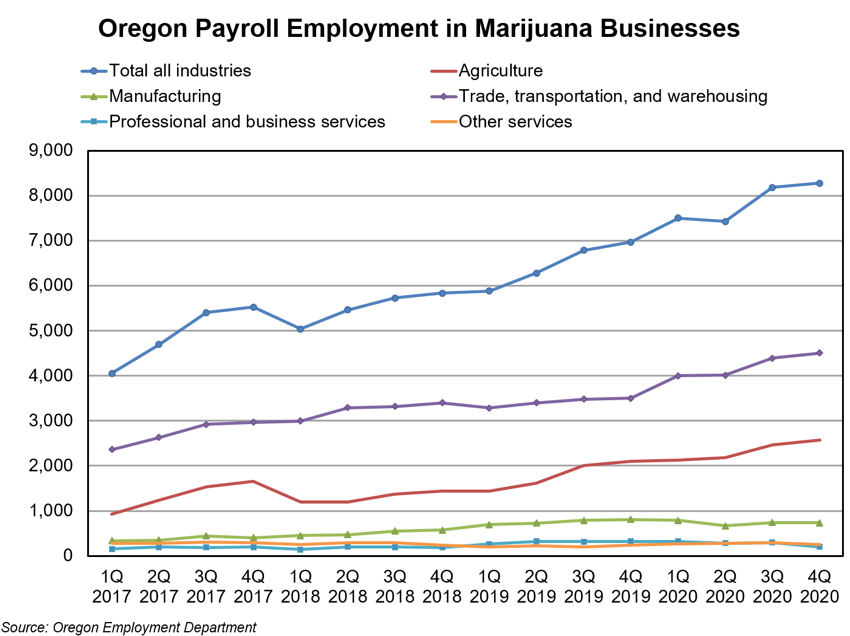

To keep up with the changes in the medical/ recreational distribution of firms in the marijuana industry, we’ve been recoding where recreational dispensaries are counted. Beginning in the first quarter of 2017, we shifted some establishments that were previously counted in the medical dispensary category “business, professional, labor, political, and similar organizations,” a subset of “other services” to “all other miscellaneous store retailers,” which is in the retail trade sector.

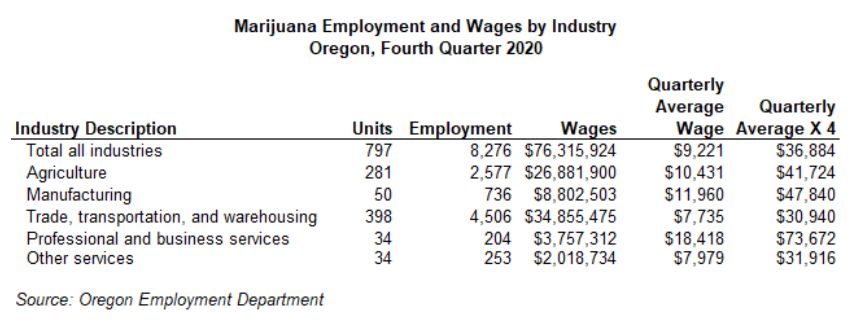

According to our most recent information, there were about 375 recreational dispensary establishments with payroll employment in Oregon totaling 4,200 jobs. The broader category that also includes wholesale trade had about 4,500 jobs and average pay of $30,940 in the fourth quarter of 2020. The following graph shows the marijuana-related business totals by broad industry group, as reported by the Quarterly Census of Employment and Wages database.

Licenses and Permits as Indicators of Employment

In other industries where some of the employment is not subject to unemployment insurance laws such as real estate brokers, we can use licensing or other records as an indicator of the level of employment.

Starting July 5, 2016 OLCC began accepting applications for worker permits. These are required of all workers in any marijuana-related firm including temporary and seasonal workers. There is a $100 fee payable upon approval. The permit is valid for five years. As of late May, 2021, 109,116 applications had been submitted. Of those, 66,946 were counted as active – meaning they were approved and paid for. Since the permits are valid for five years, the number of active permits can only go up until they start needing to be renewed. It can be assumed that all applicants have some interest in employment at a marijuana-related business. Another 15,525 were approved but not paid for, 4,556 were under review and 2,307 were new applications.

After the deadline for compliance on April 28th 2017 however, if we assume that all workers are in compliance, the number of active licenses will overstate employment in recreational marijuana. Since permits include temporary and seasonal workers it is not likely that all permitted workers will be employed on any particular day. In addition, since the permits are valid for five years, they do not capture turnover. People who quit, are laid off or otherwise not employed at a marijuana-related business can still have a valid permit.

Conclusion

According to the Office of Economic Analysis, over the extended forecast horizon, marijuana sales are expected to rise slightly faster than their previous forecast due to the rising personal income and population trends. Although with revising the rate of growth slightly upward from the previous forecast, sales in the coming years are not expected to grow as fast as the past three or four years.

One of the goals of recreational marijuana legalization was to move marijuana sales from the illicit and black market category into the regulated, tested, tracked, and measured market. The state has had success in capturing a majority share of sales through the medical and recreational programs now in place. And the steady stream of income into state and local coffers has been generally welcomed through taxation of cannabis sales at the retail level.

Oregon will continue to refine laws and rules regulating marijuana sales and production. In this fast-growing industry, constant change seems to be the order of the day for the near-term, with a gradual shift to more areas of the U.S. allowing recreational marijuana. It behooves other states to study Oregon’s example and experience in the path to a regulated recreational cannabis market, and begin their own efforts to track employment and impacts of this emerging and increasingly legal sector of the economy.

One of the large issues coming to the forefront is the demand for water that is sometimes illegally taken from wells and streams for supplying marijuana crops during the growing season. And with the dry conditions we are already facing in many parts of the state this year, those issues may continue to hamper the industry.

For more information: Oregon’s recreational marijuana industry, http://www.oregon.gov/olcc/marijuana/pages/default.aspx.

Oregon’s medical marijuana program: http://www.oregon.gov/oha/PH/DISEASESCONDITIONS/CHRONICDISEASE/MEDICALMARIJUANAPROGRAM/Pages/index.aspx.

Advertisement