March 2021 Oregon Economic and Revenue Forecast

By Mark McMullen and Josh Lehner

Oregon Office of Economic Analysis

ECONOMIC OUTLOOK

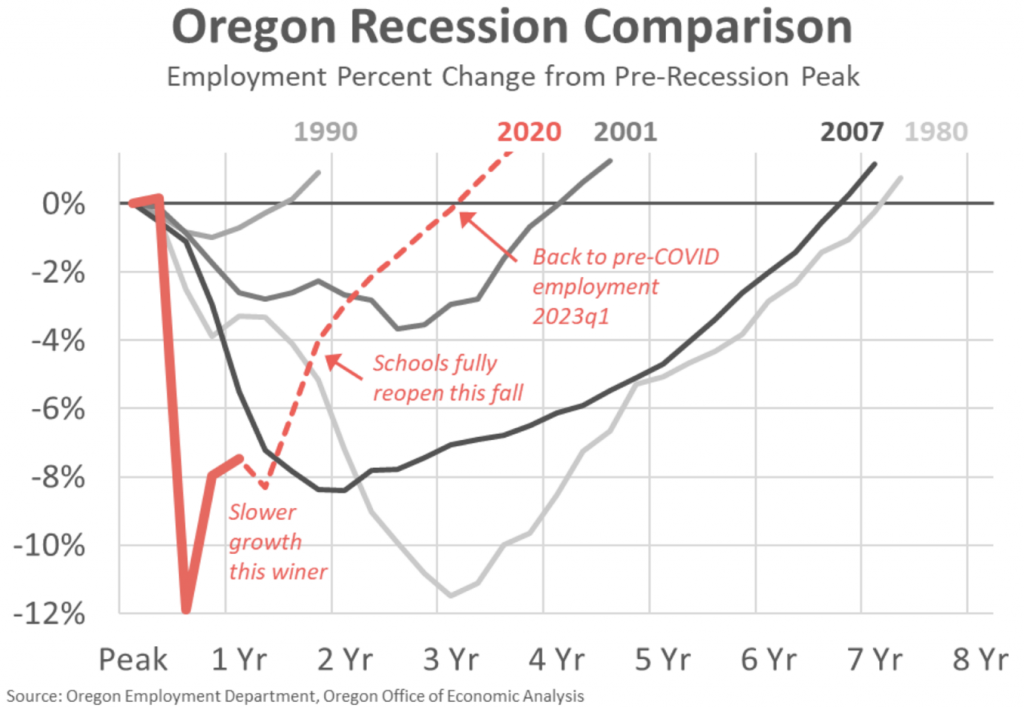

The cycle is different. The nature of the pandemic induced recession lead the economy into a severe shutdown essentially overnight last spring. Since then nearly every economic indicator has looked better than first feared. While the broad contours of the economic outlook remain the same since the start of the pandemic, the timing and strength of the recovery continue to come in above expectations.

The stage is set for a strong recovery this year and next as the pandemic wanes. This is largely due to the improvements seen in public health, the large federal fiscal policy response, and underlying resiliency in the economy. Most encouraging is that there has been surprisingly little economic scarring in the form of business closures and permanent layoffs to date.

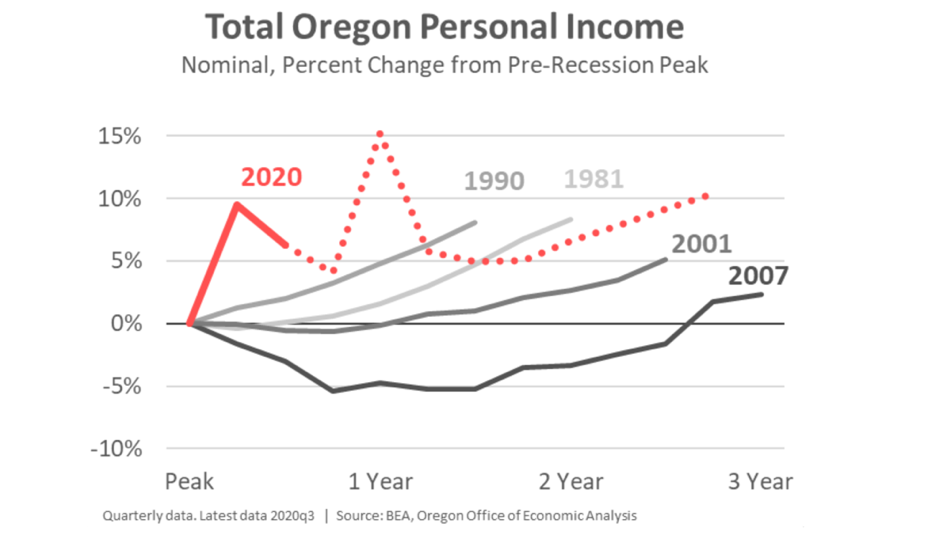

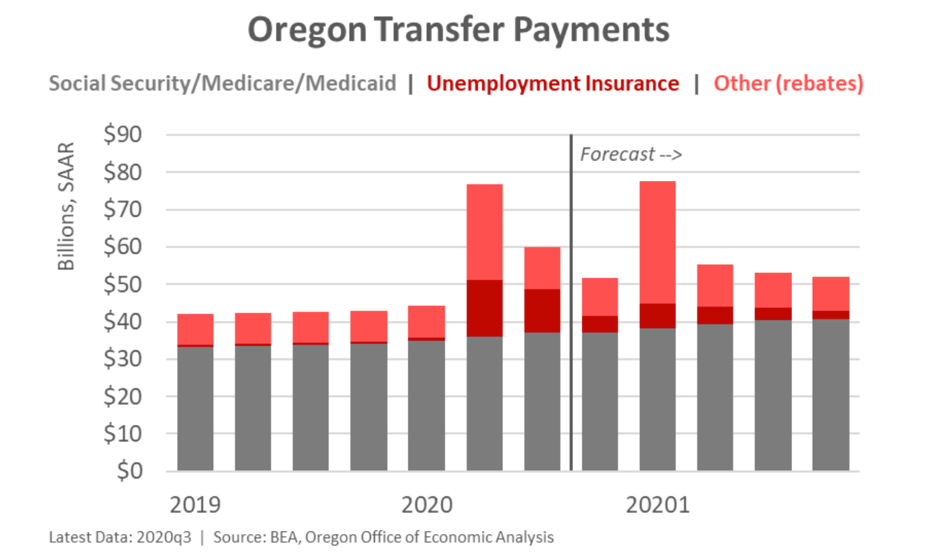

Federal aid has kept most firms and households afloat over the past year. Despite being down 160,000 jobs (9%), total personal income in Oregon today is higher than it was prior to the onset of the pandemic. Personal savings have built up among middle- and upper-income households. Pent-up demand will drive stronger growth in the months ahead.

The shift in consumer spending out of physical goods and back into labor-intensive, in-person services will result in large employment gains this year and next. The full return to in-person schooling this fall will provide a double boost to the economy as well. There is the direct jobs increase of hiring more teachers and staff, in addition to the indirect boost from freeing parents to rejoin the labor force or increase their hours worked in greater numbers. Overall, Oregon’s economy will return to health by early-2023. This is 6-9 months sooner than expected in recent forecasts and more than a full year earlier than expected in the first post-COVID forecast released last May.

Pandemic Progress

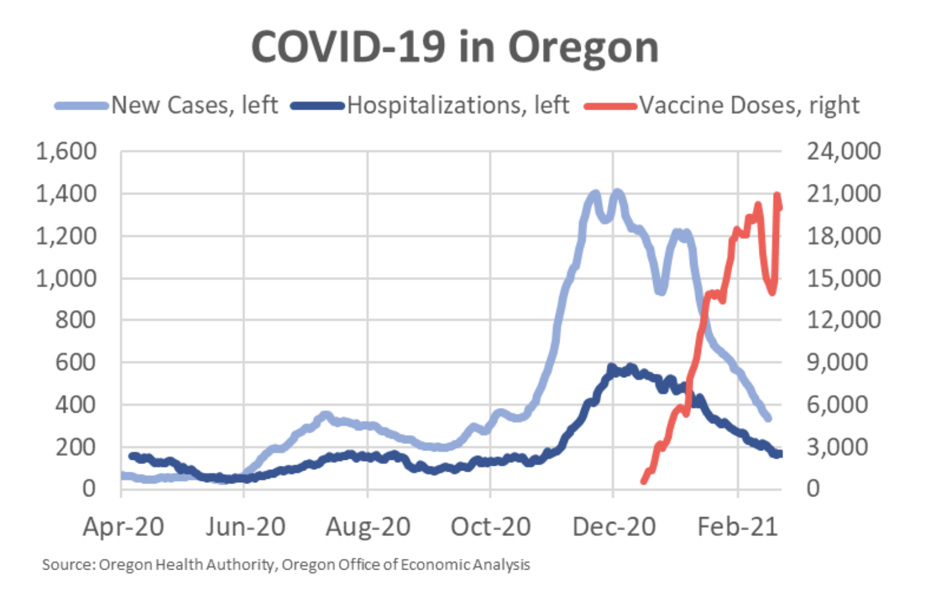

The economy is emerging from a dark winter. The virus’ resurgence last fall lead to more restrictive public health measures and consumers pulled back out of fear. While economically painful, this was expected.

Both Oregon and the U.S. lost jobs in December. In January the U.S. eked out a small gain – Oregon data is not yet available. Early indications1 are that March does not look to be any better on the jobs front, even as consumer spending is picking up. Our office has built in job losses for the first quarter due to the dark winter.

That said, as the snow and ice melt and the calendar turns to spring, economic growth will accelerate noticeably. The number of vaccines in Oregon has increased considerably. Currently more than 548,000 Oregonians have received at least one dose of the vaccine, approximately equal to 16% of the state’s adult population. As consumers feel more confident in their ability to safely resume previously limited activities, the economic recovery will accelerate in the months ahead. The outlook brightens with every inoculation.

While the pandemic progress is highly encouraging, there do remain public health risks. While not part of the baseline outlook, a resurgent virus due to new variants, vaccine distribution issues, or a seasonal component next fall, would slow the pace of recovery. Similarly, should the vaccines continue to prove effective against the new variants and a large enough share of the population chooses to receive the vaccine to truly reach herd immunity, the recovery could be even faster and stronger than currently expected.

Federal Fiscal Policy

Economic growth in 2021 is shaping up to be one of the strongest years in decades, possibly generations. The primary reason for this is pent-up demand that will lead to very strong consumer spending in the quarters ahead. Incomes are up due federal fiscal policy and spending is suppressed by the pandemic.

The combination of recovery rebates and expanded unemployment insurance benefits means total personal income today is higher than it was prior to the start of the pandemic, despite the significant job losses. Such support is unprecedented when comparing to recent recessions. Even more encouraging is that underlying personal income excluding the direct federal aid is now back to pre-pandemic levels. The economy has proved much more resilient than feared a year ago.

This forecast also assumes another major federal relief package, similar to what is being currently debated in Washington D.C. All told this new package will deliver aid of approximately the same size to Oregonians as the CARES Act did a year ago. The composition of the aid will be somewhat different, however.

First the upcoming recovery rebates will be larger at $1,400 per

person – thus bringing the total to $2,000 when combined with

the $600 passed in late December – compared to the $1,200 per

adult and $500 per child in the CARES Act. Second, the amount

of expanded unemployment insurance benefits will be lower

due to both an improving labor market, and a reduced level of

benefits at an additional $300 or $400 per week instead of the previous $600 per week.

Pent-Up Demand

Many forms of consumer spending have been restricted by the pandemic, from indoor dining and nightlife to air travel and routine dentist appointments. However, with incomes up, consumers have continued to spend where and how they are able to. The overall patterns in consumer spending have shifted strongly into physical goods, e-commerce, and home entertainment including streaming services. Furthermore, car sales and home sales have rebounded strongly since last spring.

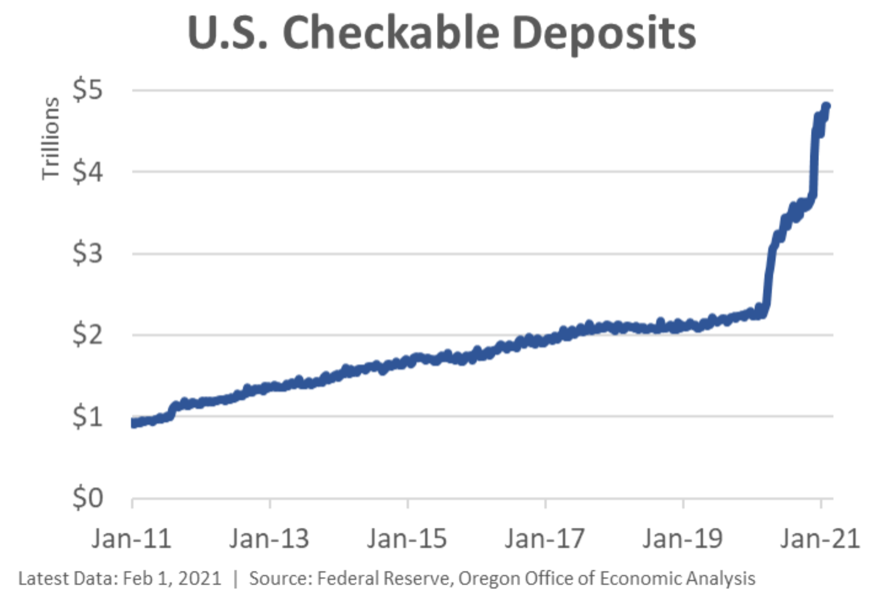

That said, even with the strong spending on goods, households have accumulated sizable savings in the past year. Despite consumers’ best effort, they are unable to spend as much ordering online as they typically do going out to eat, on vacations, and getting their hair cut. Nationally, households have built up nearly $2 trillion in excess savings. Here in Oregon financial institutions have seen substantial increases in deposits. Much of this savings is currently sitting in bank accounts, ready to be spent when the time comes or invested long-term.

Looking forward, as the economy continues to reopen and

households become more confident in their ability to venture

out safely, consumer spending will accelerate. Patterns of

spending will also start to move back toward old habits. This shift out of physical goods and back into labor- intensive, in-person services will create strong employment growth later this year.

Specifically, large service-providing industries like health care, leisure and hospitality, and other services – namely barbershops and nail salons – will need to staff back up quickly as consumer spending rises. These sectors account for more than half of the current jobs hole today. Some subsectors like health care, social assistance, and food services have reduced their employment proportionately to the drop in consumer spending during the pandemic. Effectively that means for every increase in spending in the months ahead, these firms will need to hire more workers to meet consumer demand.

Other subsectors like art, entertainment, recreation, and accommodations have experienced much larger revenue losses and undertaken comparatively smaller levels of layoffs. This likely means two things. First, these firms may not need to staff up as quickly as they can absorb a sizable increase in demand before needing to bring on additional labor. Second, these firms are very likely operating at losses in the past year. They may be unable to lower labor costs to match revenue declines and rely on retained earnings, raised additional capital, or issued debt to remain in business.

All told, the shifting from current above-trend sales in physical goods back into services would increase national employment by a couple million jobs, and Oregon employment by around 20-25,000 jobs. This shift in patterns of spending combined with pent-up demand that is unleashed will drive strong overall employment growth this year and next.

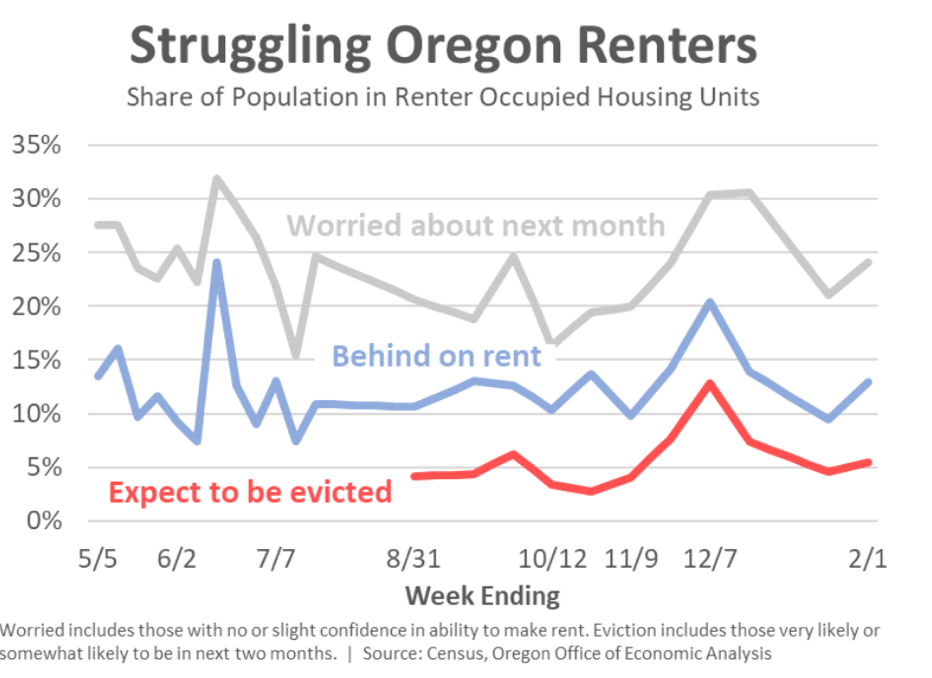

Of course the accumulation of excess savings is almost entirely concentrated among middle- and high-income households. Lower-income households have continued to struggle as many workers in the low-wage service industries face dim job prospects until the pandemic is over. They have also had to overcome lapses in federal aid multiple times in the past year. For this reason, ongoing federal assistance in the form of expanded unemployment insurance and recovery rebates that reach those who do not qualify for UI is needed to ensure more of our neighbors, family, and friends do not fall behind on bills or rent.

Recent survey data indicate that after the passage of the COVID relief bill in December, the number of Oregon renters behind on rent or worried about eviction began to decline after rising in recent months. The passage of another major federal relief package, as assumed in this forecast, will go even further to ensuring more Oregonians and Americans do not fall further behind.

Potential GDP and Risk of Overheating

Strong consumer spending and additional federal aid this year will provide a nice tailwind for the overall economy. However, given these underlying fundamentals combined with rising asset values and a Federal Reserve that continues to signal it is not even beginning to think about raising interest rates, don’t these conditions lead to rising inflation and an overheated economy?

The classic answer would be yes. The combination of the CARES Act, December’s COVID relief bill, and the expected federal package in the weeks ahead total more than 20% of GDP. The pandemic induced a drop in GDP more like 11%. As such the potential for an overheating economy is there. The ultimate risk lies in that should inflation accelerate permanently, the Federal Reserve will have to raise interest rates, probably substantially, likely leading to an ensuing recession.

However, there are at least four reasons why this is not as large of a concern today, even as it remains a risk.

First, inflation expectations remain well anchored. There are no signs yet that households or firms are expecting accelerating inflation in the years ahead. The Federal Reserve monitors changes in these measures closely.

Second, the economy has experienced disinflationary pressures for decades. Actual inflation was noticeably below the Federal Reserve’s 2 percent target for nearly the entire economic expansion that ended a year ago. A modest uptick in inflation is more than welcomed from a policy perspective.

Third, to the extent any unleashing of pent-up demand drives the prices of consumer services higher – airline tickets, hotel prices, amusement park admissions, etc – these pressures are likely to be transitory. Prices would rise this year due to surging demand, but are unlikely to continue to increase at such fast rates every year into the future. Absent broad-based wage push inflation, any pickup in inflation in the near future is not expected to be persistent.

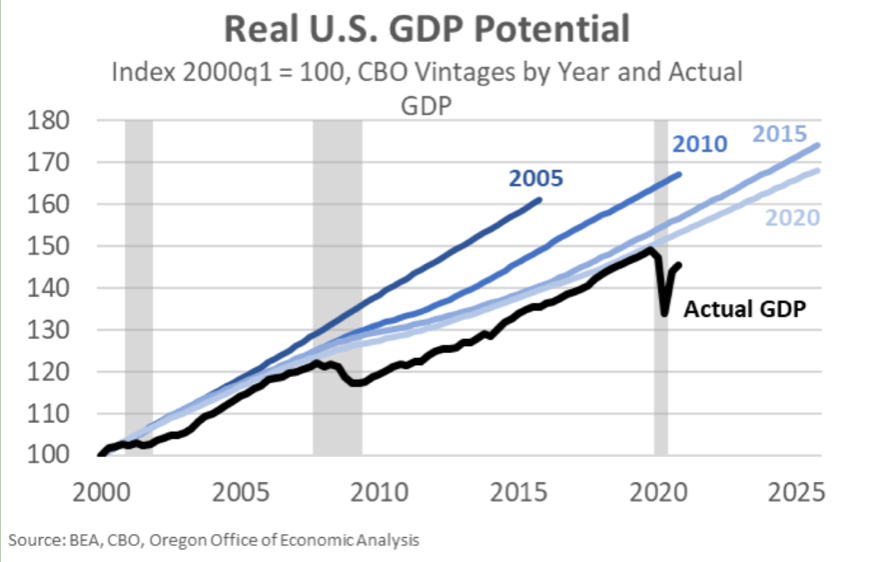

Fourth, many of the concerns over an overheating economy rest on the concept of potential GDP. Essentially, if all of the available resources were put to use effectively, how large would the economy be? The concept has clear theoretical implications, yet proves difficult to measure

in reality. Even so, current estimates of the so-called output gap – the difference between the actual level of GDP today and the potential GDP – peg it around 4% in the U.S. An additional federal aid package of around 10% of GDP would clearly push the economy above potential and could lead to overheating.

However, estimates of potential GDP have continued to be

revised down in recent decades. Since the Great Recession

ended, the Congressional Budget Office (CBO) has lowered

their estimates of potential GDP by 10 percentage points or so. Relative to pre-Great Recession expectations, potential GDP estimates have been revised down more like 15 percentage points. Breaching the current downgraded estimates of potential GDP is not concerning when viewed in a broader context.

Furthermore, past cycles show that a strong, even a hot economy are necessary conditions to see changes in the underlying drivers of long-run growth like productivity and labor force participation rates. In particular, businesses invest in and adapt new technologies to a greater degree, which boosts productivity years into the future. Today, business investment in software, computers, and cloud computing have all accelerated during the pandemic, in part due to the rise of remote work. Furthermore, when jobs are more-plentiful and higher-paying, like they are in a strong economy, more individuals enter into the labor market in order to find work. Any boosts to productivity or the number of workers should raise the long-term potential growth path of the economy. To the extent this occurs today, then worries over the current estimates of the output gap are misguided at best.

On a related note, concerns over economic disparities, be they racial or ethnic, geographic, or income in nature, are also likely to lessen in a stronger economy. In recent years, Oregon finally began to see the racial poverty gap begin to close, in large part due to the strong labor market by the end of last decade. Similarly, income inequality was falling some as wage and income gains among lower- and middle-income households outpaced those at the top. In a tighter labor market firms have to dig deeper into their resume stacks to hire workers they may have previously passed over. Additionally, companies had to compete more on price (wages) to attract and retain workers. A strong economy can work wonders, even if it does not cure all ills.

Economic Scarring

The solid economic foundation prior to the pandemic should aid in recovery, or at least not hinder it. Unlike past recessions, there are few structural macroeconomic imbalances to overcome or work through. In past severe recessions the restructuring of the timber industry in the 1980s and the household debt overhang from the housing bubble slowed the pace of recovery. Something similar does not appear to be an issue today, leading to a quicker recovery in the years ahead.

Of course, the cycle is not over yet. Economists remain very concerned about business closures and permanent layoffs. The more of this economic scaring that accumulates, and there will be more, before the recovery can truly get underway will weigh on the strength of that recovery. Even under the best of circumstances it takes time for new firms to replace the lost ones and for laid off workers to find new jobs. Clearly 2020 and the start of the 2021 are not the best of times.

Business Closures

The pandemic has impacted all aspects of the economy to varying degrees. Small business in particular appear the most vulnerable as they generally lack sizable reserves, access to capital markets like large businesses, and at times even traditional banking relationships.

Unfortunately, we know not all small businesses have or will survive the cycle. The question is just how much damage is done and what does it mean for the overall outlook? Estimates here vary. Some third party data sources that track firms using a particular software or the like, indicate that an apocalyptic 30% of businesses in Oregon have closed. Those same sources indicate an unfathomable 50% of leisure and hospitality firms have closed.

While solid data on firm closures takes time, let’s run through the actual hard data that is currently available.

First, the total number of active business licenses as reported by the Oregon Secretary of State have increased 1.7% from January 2020 to January 2021. Similarly the number of private sector “business units” as reported by the Oregon Employment Department has increased 2.9% from 2019q4 to 2020q3.

Second, businesses close every year, even in good economic times. During the 1990s economic expansion around 8% of Oregon firms closed each year. Last expansion that improved to around 7% of firms closing each year. These figures rose to 10-12% of businesses closing during each of the past severe recessions in the state including the early 1980s and in the aftermath of the Great Recession. While sizable increases in the number of firms shutting their doors, this is nowhere near some of the estimates cited in the past year. Either the pandemic generated three times the number of closures as these past severe cycles or these third party data estimates are not truly representative of the overall economy.

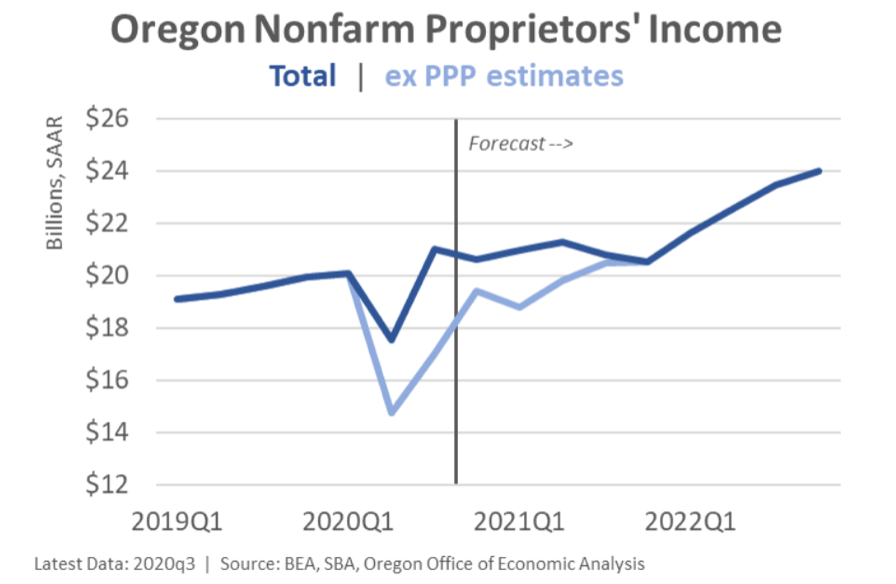

Third, small business income is largely flat over the past year thanks to the Paycheck Protection Program. While the PPP is flawed and insufficient at saving some of the most vulnerable firms, including those who lacked existing banking relationships, the level of support for Oregon firms totaled just over $7 billion last year. Absent the PPP, proprietors’ income fell nearly 20%. That is an apocalyptic drop that few businesses could survive on their own. Thankfully some firms were able to access the PPP last year and this year to help support their operations.

Fourth, what timely data we do have for bars and restaurants – the most impacted sector in terms of the pandemic – show that firm closures are up in the past year, but not nearly as much as the conventional wisdom or miscellaneous third party data source indicate. Specifically, OLCC liquor license renewals continue to hover around 92%. This is down from the 97-98% renewal rates prior to the pandemic. Total active liquor licenses for on-premise sales over the past year are down around 5%. Similarly, the number of video lottery retailers who were open and reporting sales was down 7% last fall, prior to the more restrictive public health measures going into effect. Further research by the Oregon Lottery found that a couple percent of retailers continued to keep their doors closed due to the pandemic and uncertain economic outlook and had not permanently shuttered, or at least not yet. Overall there is a clear increase in closures among bars and restaurants in Oregon, however that increase thankfully appears to be around 5% not 50%.

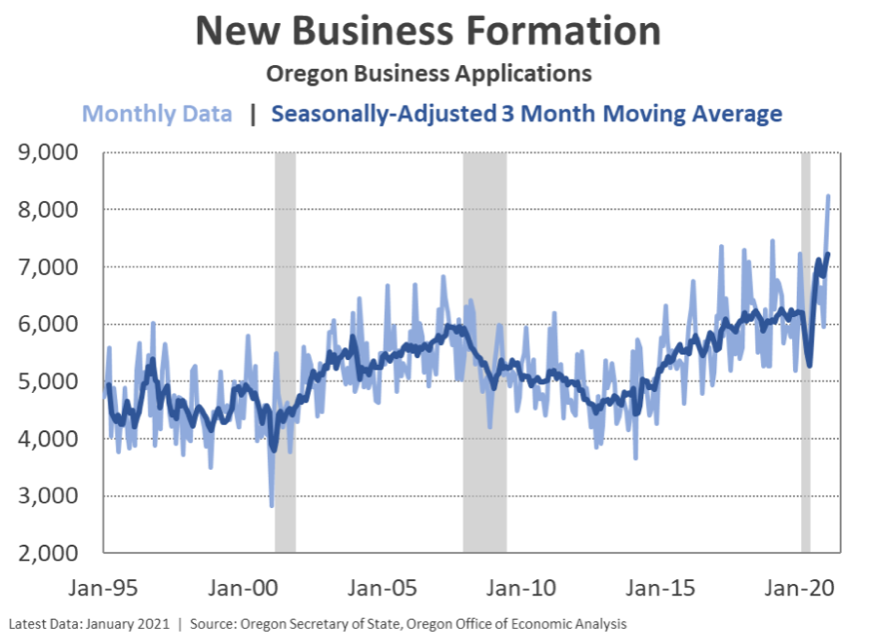

Fifth and finally, the most encouraging data point in terms of business dynamics relates to the ongoing strength in new business formation. Start-up activity has surged since the shelter in place phase of the pandemic ended. This is seen in the business application data as reported by both the Census Bureau and the Oregon Secretary of State.

Best case scenario here is that the rising number of start-ups

means innovation and productivity will increase in the years

ahead, boosting long-term growth prospects. At a minimum

the higher number of start-ups means the economy will not

suffer the double blow of more closures and fewer start-ups

as has been the case in past severe recessions and which would slow the overall recovery.

Permanent Layoffs and Long-Term Unemployment

In addition to firm closures, permanent layoffs are a key economic issue to watch. The data continue to point toward most unemployment being temporary in nature; that is workers expect to return to their jobs when it is safe to do so and customers return in greater numbers.

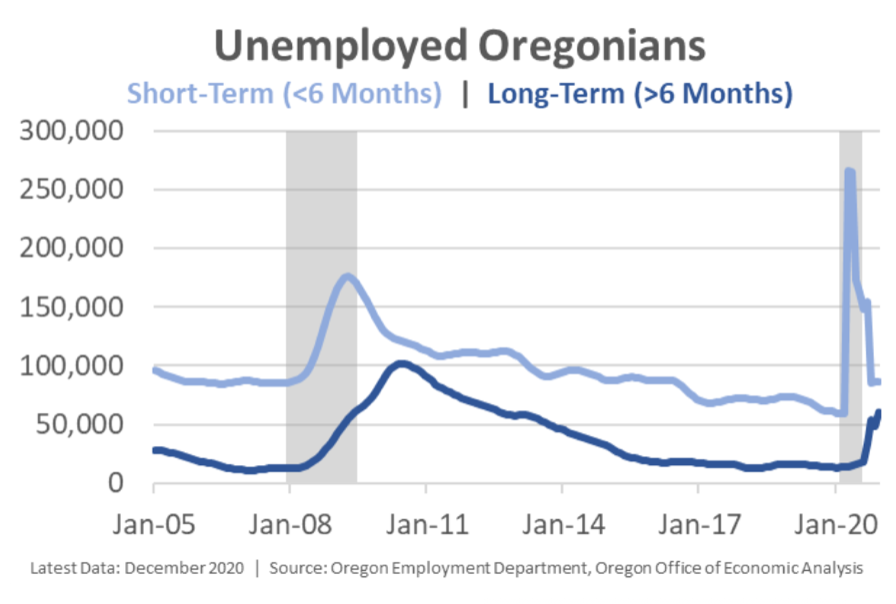

However, now that the pandemic and its impacts on our daily lives has lasted this long, we are starting to see a rise in long-term unemployment – generally defined as longer than six months. In December, 60,000 Oregonians had been looking for work for at least the past six months, more than quadruple the 13,000 or so pre-pandemic. As a full recovery remains a year or two away, the number of long- term unemployed will continue increase in the months ahead.

Long-term unemployment has real economic, human, and

social costs. The longer a spell of unemployment lasts, the lower the probability of finding a job and the higher probability of dropping out of the labor force entirely. This reduces the productive capacity of the economy as fewer people are available for work.

In terms of the long-run damage from high levels of unemployment there are four reasons for some level of optimism this time around.

First, the expected federal aid package will continue expanded unemployment benefits into the fall of this year providing much needed financial support.

Second, job postings – a measure of labor demand as firms look to hire – are rising again. Online postings at Indeed have recently reached an all-time high, while other measures of job openings indicate growing, but not yet a fully recovered number of postings.

Third, the industrial composition of the long-term unemployed today mirror that of the short-term unemployed. While this is always generally kind of true, the relationship is even tighter today. To the extent there is a large pool of applicants who have been mired in pandemic-related job losses, firms may not pass over the longer-term unemployed as often as they have in past cycles. The strong rebound in consumer demand for labor-intensive, in-person services later this year means firms will need to staff up quickly, hopefully hiring short-term and long- term unemployed workers alike. Even so, the risks for the long-term unemployed are they lose connections to their professional networks, or the hiring manager changes, and the like.

Fourth, as discussed previously, workers return to the workforce in great numbers when jobs are more-plentiful, and higher-paying. A fast return to such an economy should minimize some of these long-term concerns. Encouragingly, wage growth continues to be strong for the workers who have not been laid off during the pandemic.

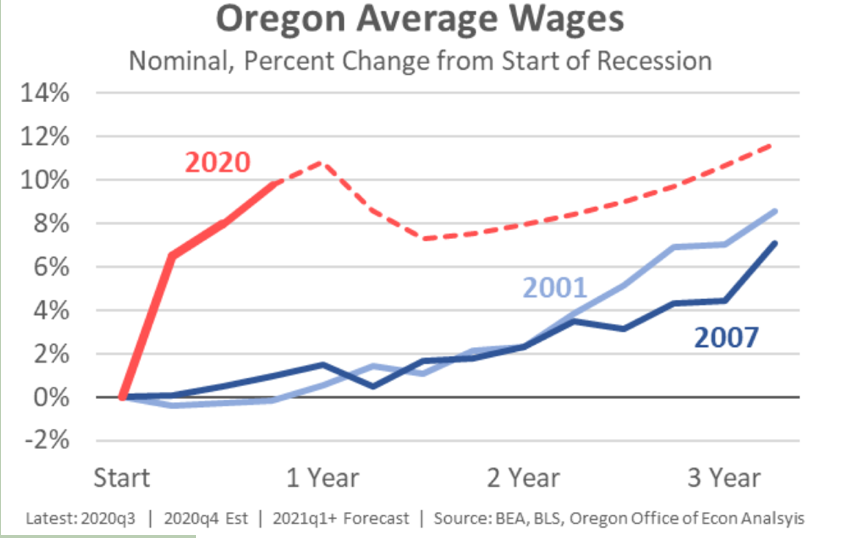

Overall, the average wage in Oregon has risen 10 percent since the start of the pandemic. Six or seven percentage points of the increase, however, is due to the compositional changes in the labor market. That is, as lower-wage jobs in bars, restaurants, nail salons and the like have disappeared due to the pandemic, that means mathematically the average wage of the jobs that remain has risen.

Even so, the workers who have remained employed since the start of the pandemic are continuing to see solid, underlying wage increases themselves. These gains account for three or four percentage points of the average wage increases. This is surprising and above expectations, at least when compared with recent recessions.

In terms of the outlook, average wages will decline a few

percentage points in the year ahead as the economy

reopens and many of the lower-wage, service sector jobs

return. However, unlike past cycles where there was a

period of lackluster wage gains due to economic slack, our

office’s forecast calls for ongoing solid wage increases in line with growth seen prior to the pandemic and for those employed throughout the pandemic.

Online Learning and Parents in the Labor Force

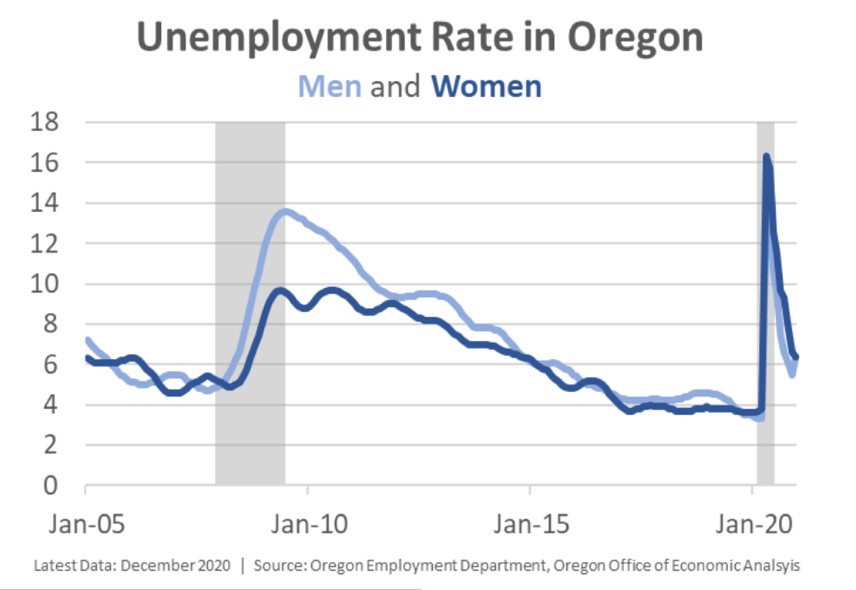

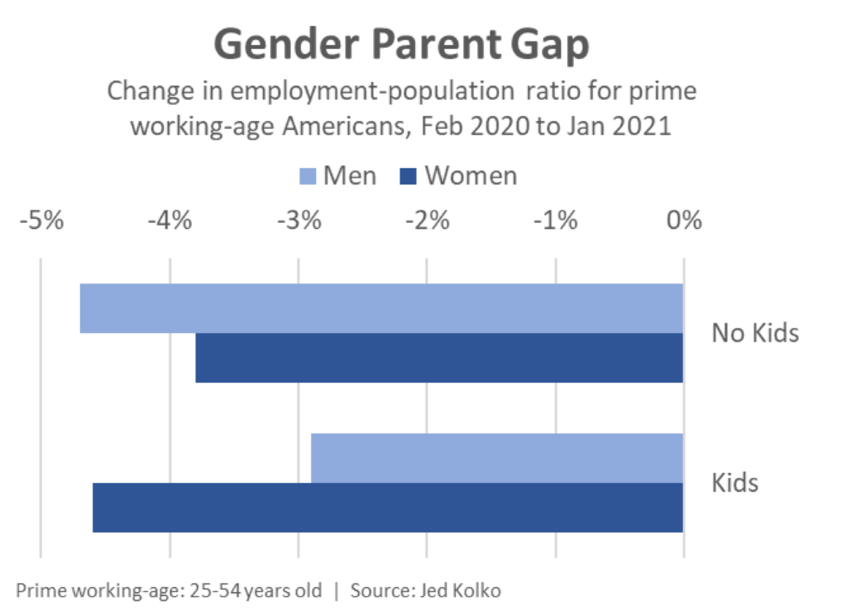

Women suffered disproportionate layoffs and higher unemployment rates at the start of the pandemic. However since last spring, much of the gender gap in employment has effectively closed. As of January 2021, male employment in the U.S. was down 5 percent, while female employment was down 6 percent. Here in Oregon the female and male unemployment rates in December 2020 were the same. Noisy monthly data can be challenging and has resulted in some stronger headlines about these gender differences than is probably warranted from the big picture perspective.

That said, while these topline numbers do not show large

gender disparities, the same cannot be said if we focus just on parents.

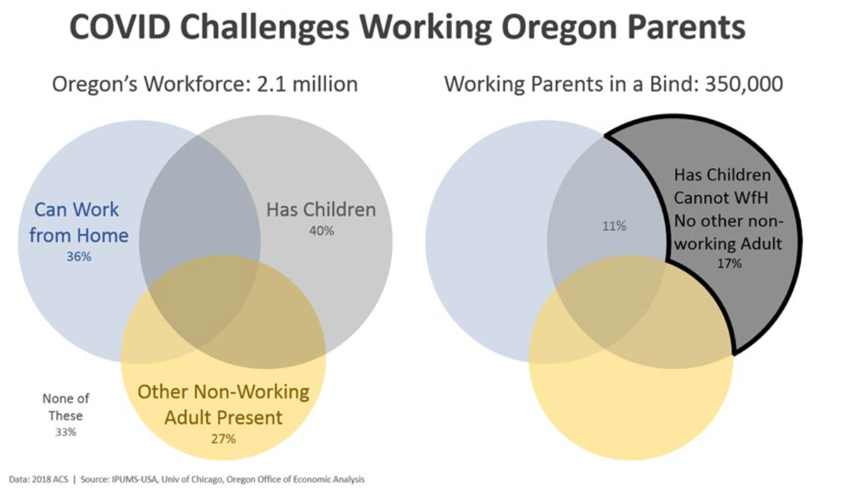

Overall we know that many families are in a bind with online learning. Nearly 1 in 5 Oregonians in the workforce meet the following definition: they have children, work in a job that cannot be done from home, and do not have another non- working adult present in the household. These Oregon parents likely face the direct trade off of going to work, or staying home to take care of the kids, or trying to arrange childcare which is restricted by the pandemic and hard to find and afford to begin with.

Another 11 percent of Oregon’s workforce has kids, do not have another non-working adult present, but can work from home. Juggling work responsibilities and ensuring their kids attend class and get their homework done is a daily struggle, to say the least.

In America we know taking care of the family and household more broadly disproportionately falls on moms. Nationally moms have seen much larger employment losses than dads have. In fact nearly 1 million moms have left the labor force in the past year, twice that of dads. In Oregon that’s the equivalent of around 12,000 mothers leaving the labor force.

Besides the lack of in-person schooling, another contributing factor to the gender parent gap is likely the gender wage gap. If a household has to choose an adult to stay home, it makes more financial sense for the lower- earning worker to do so, which usually means the mom.

Looking forward our office has built in two impacts in the economic outlook from a return of in-person schooling.

First there are the direct jobs associated with in-person schooling. Education employment is down considerably since the start of the pandemic. A portion of these losses are office staff, lunch workers and bus drivers, however the vast majority of the losses are teachers themselves. This is primarily due to the lack of substitute teachers being used with online learning, not layoffs to full-time teaching positions. Given around 75 percent of elementary and middle school teachers are women, and high school teachers are evenly split between men and women, the direct jobs boost from in-person learning will disproportionately impact women.

Second there is the indirect impact of freeing parents’ ability to work when the kids return to the classroom. Parents – primarily moms – will be able to work again if they want, increase their hours, or at a minimum be more productive as they will no longer be simultaneously trying to manage online school and do their jobs.

As the pandemic wanes, our office expects a stronger economic recovery than has been experienced in recent cycles. As a result, Oregon parents are likely to return to the workforce in greater numbers this year as the kids return to classrooms and businesses are looking to hire to keep up with demand. That said, it is always important to continue to monitor these big changes seen during recessions.

In the years leading up the pandemic, Oregonian moms had

begun to return to the labor force in greater numbers due

to the strong economy. In fact the share of Oregon moms

in the labor force hadn’t been higher in decades. While not the baseline outlook, it is possible the pandemic will undo much of these gains. In the event this does happen, it would likely take years to regain the losses.

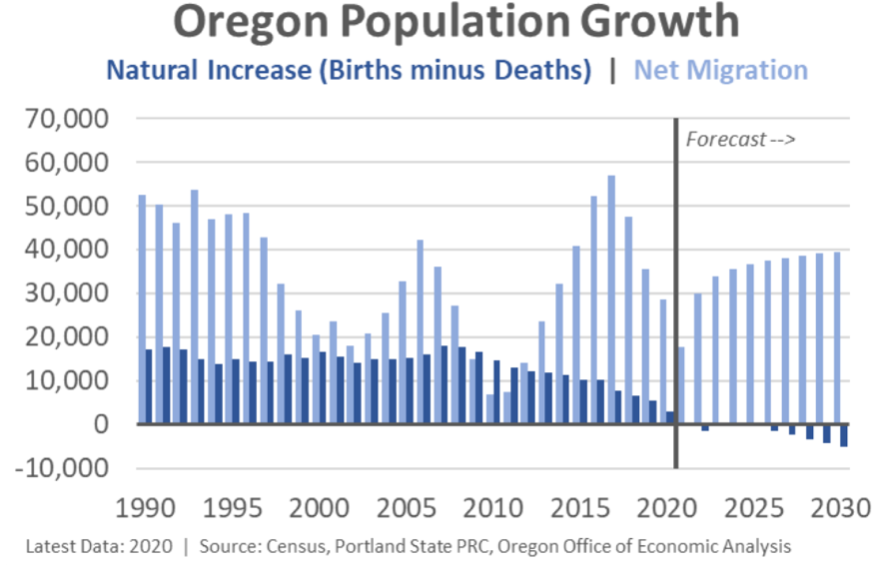

Note on Population Growth and Housing

Our office’s population and demographic forecast has been updated, see page 25 for a broader discussion and the underlying details. The upshot is births continue to remain low, while deaths are rising due a general aging of the population, increases in the so-called deaths of despair, and COVID. Over the extended forecast horizon deaths are now expected to outnumber births. As such, Oregon’s population growth will rely entirely on net migration.

A key unknown today is just how strong migration has been during the pandemic. We know in recent years population growth has slowed, including through the latest mid-2020 population estimates published by Portland State’s Population Research Center.

While not the convention wisdom, which seems to be there

is a large increase in pandemic-related migration, this

pattern overall does make sense. Most migrants follow job opportunities. As the business cycle matured in recent years, job growth slowed and so too did migration. Then the pandemic hit, leading to layoffs and the shelter in place phase of the cycle. Hardly anyone moved last spring or early summer. Since then, however, indications are migration has firmed. Population growth in the latter half of 2020 will show up in the 2021 population estimates released late this year.

That said, using the strong housing market as a harbinger of migration trends is challenging. Home sales always overstate population growth as the differences between the types of homebuyers matter considerably. Some local residents sold and moved away. In the big picture, new buyers are simply replacing them. Similarly, local move-up buyers, or renters shifting into ownership represent home sales but no population growth. Likewise an increase in second homes impacts the housing market but not the underlying economy as those households are not bringing their skills, talents, and income with them.

Ultimately what matters for the regional economy is the growth among the working-age population, many of whom move to the area from elsewhere. What matters to the housing industry are rates of household formation among 20- and 30-somethings and the relative demand for different types of housing options. Here, the monthly household survey indicates that household

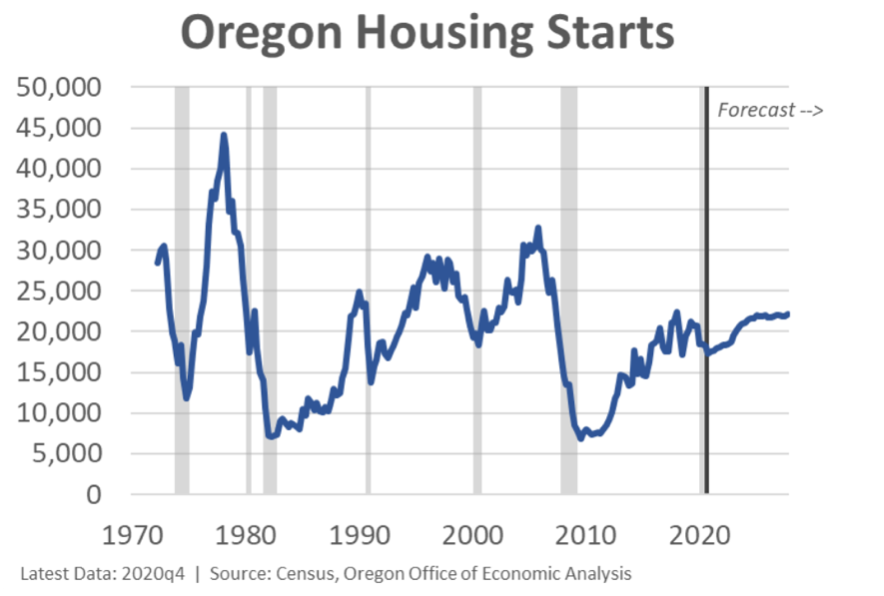

formation continues to hold steady after taking a brief drop during the shelter in place phase of the cycle. This indicates ongoing demand for housing in Oregon, and the need to ensure adequate levels of new construction.

Our office’s housing starts forecast calls for fairly steady levels of new construction in the years ahead. There has been a large drop in multifamily activity in Portland proper but ongoing strength in multifamily construction in the suburbs and elsewhere around the state. Single family construction is strong across the state.

Economic Impact of Ice Storms and Grid Resiliency

Almost the entire country recently went through some form of a cold snap and disruption to the local economy and our personal lives. However in Oregon, hundreds of thousands of our family, friends, and neighbors went without power for multiple days. Most are in the Willamette Valley. Given that the Portland and Salem regions account for 58% of the state’s population, 63% of personal income, and 67% of GDP, anything that happens there will have a considerable impact on statewide numbers.

In terms of the direct economic impacts of the storms, and natural disasters more generally, it is pretty straightforward. Transportation is heavily disrupted and the storms clearly throw a wrench in logistics. For example both I-84 in Oregon and SR-14 in Washington were closed for an extended period of time, meaning east-west traffic through the Gorge was delayed or potentially rerouted which added hours to any trip. There is physical property damage in the form of collapsing roofs, icy roads, frozen pipes, and falling trees or debris. There are repair costs to all of these damages for private firms, the public sector, and utility companies. Perversely the cleaning up and rebuilding phase is a boost to GDP growth, but not to overall societal welfare. Additionally, outdoor industries like logging, construction, and agriculture — both crops and livestock — are restricted and likely lost product as well. On the other end some industries did see an increase in sales and activity as local residents stocked up on groceries ahead of the storm, and hotels filled up as people needed a warm place to stay.

Overall these disruptions likely caused a short-term drop in economic activity, and wages earned. Hourly workers are the most affected as they miss shift(s) because they cannot get to work due to the weather and/or because businesses close. To some degree, the pandemic and working from home likely muted some of these traditional impacts from natural disasters.

In Oregon there were no major electrical generation (supply) issues like elsewhere in the country. Local problems were primarily about the transmission and delivery of the electricity due to downed power lines. The personal and economic impacts in recent weeks are more about grid resiliency and being without electricity for days on end.

An Obama era Council of Economic Advisors report on grid resiliency finds that weather-related power outages nationwide have been rising in recent decades; a trend expected to continue due to climate change. Power outage costs include lost output and wages, spoiled inventory for businesses and households, and the inconveniences and cost of restarting industrial operations. Annually, power outages cost between $18 and $33 billion per year. At the time the report was written (2013) that was equal to a tenth or two of a percentage point of GDP. Years with larger events (disasters and storms) had even larger costs.

Such findings are confirmed elsewhere in the research, including Degelia et al (2016) who write that “the effect on power lines tends to be the main and longest lasting impact of ice storms as power supplies often remain off for long periods of time, even after the ice storm has passed.” In addition to the economic costs, Degelia et al discuss some of the societal, human, and environmental impacts as well.

While heatwaves generally cause more deaths than do severe winter storms, there are increases associated with both. Essentially whenever temperatures deviate significantly from normal local conditions, bad health outcomes occur. In cold temperatures there are some deaths attributable to direct exposure in terms of hypothermia, frostbite and the like. More deaths tend to come from complications of underlying respiratory and heart conditions as cold is a stressor on the body. Furthermore, indirect deaths from falling debris, or improperly ventilated generators as happened in 2012 in the aftermath of Superstorm Sandy on the East Coast, unfortunately occur as well.

Finally, a more modern impact of power outages and need for grid resiliency is the loss of an internet connection. Broadband access is an increasingly important part of society, both economically and culturally. This includes those working from home, in addition to online schooling, and to say nothing about entertainment options to help pass the time, especially when the pandemic already restricts what we can do in the first place.

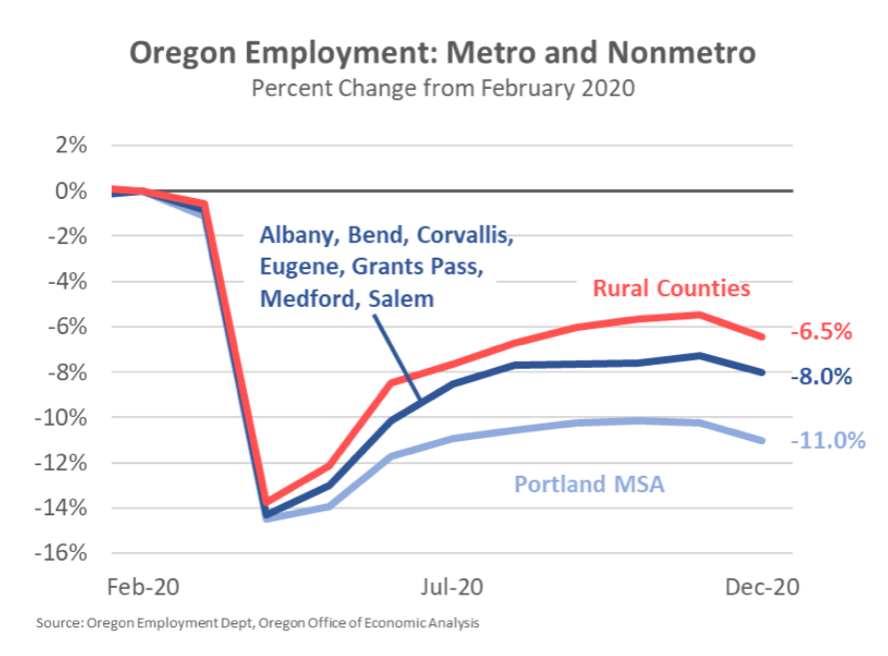

Regional Comparisons

To date the urban-rural divide has shrunk so far this cycle. The severity of the initial recession varied mostly due to the local industrial structure. Places like the North Coast, Columbia Gorge, and Central Oregon that have an outsized tourism and related sector experienced the largest declines. However, other areas of the state experienced somewhat smaller losses, including much of rural, eastern Oregon. Transfer payments account for larger portions of total personal income in rural areas as well so increased transfers during the pandemic may disproportionately support these economies.

So far in recovery, the Portland region has seen the slowest growth. This may be due to the lack of rebound so far in high paying industries which tend to be located predominantly in urban areas. Additionally major job centers like downtown Portland have seen a large drop in activity due to hardly any business travel, and an increase in working from home. Additionally, on a smaller scale in terms of impact, the protests and clashes of violence may be in play as well.

While the urban-rural gap is not widening today, over the full

cycle it may. Long-run economic growth is primarily about the

number of workers and how productive each worker is. Population gains are strongest in urban areas, which should propel these regional economies to faster growth. Additionally, urban areas, have larger concentrations in the industries expected to grow the fastest in the years ahead than do many rural areas. As always, keep eye on capital (financial, human, natural, physical, and/or social) and investments as those will help drive productivity and overall growth in our regional economies.

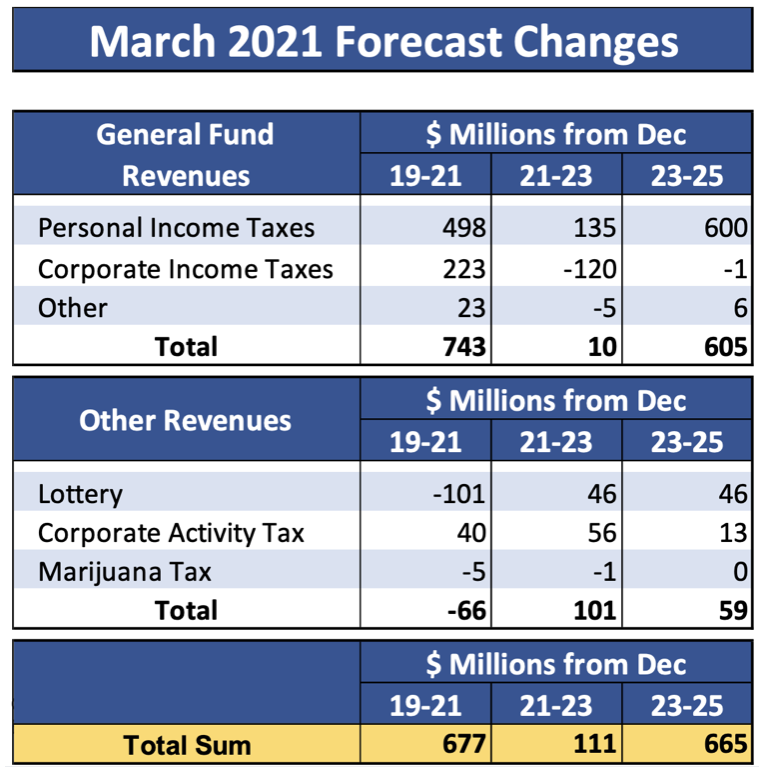

A more complete summary of the Oregon economic outlook and forecast changes relative to the previous outlook are available as Table A.2 and A.3 in Appendix A. Additionally see our office’s Alternative Scenarios on page 13 for more on why the baseline outlook may be too optimistic or pessimistic.

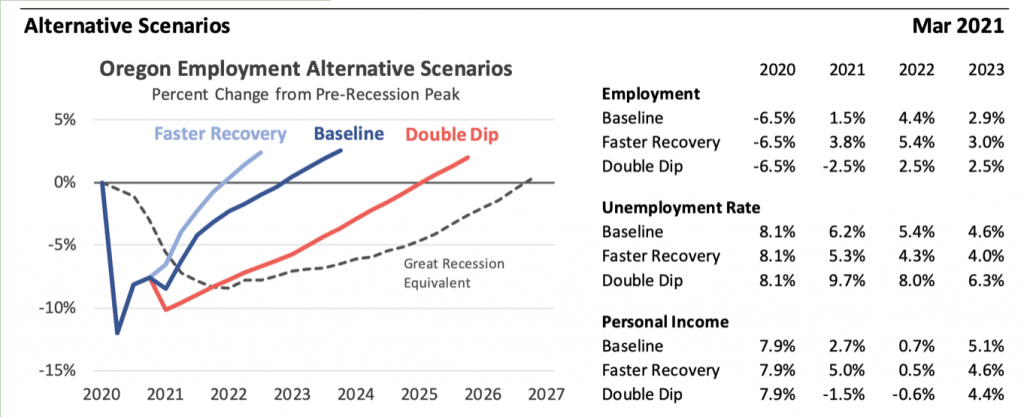

Alternative Scenarios

The baseline forecast is our outlook of the most likely path for the Oregon economy. As with any forecast, however, many other scenarios are possible. Given the uncertainty about the path of the virus and public health, in addition to the relative changes in the temporary versus permanent economic damage still to come, the range of potential outcomes is larger than usual. The key points on the path to recovery revolve around the timeline for a widely available medical treatment, the potential for a double-dip recession, and the duration of the entire cycle. The two alternative scenarios below are not the upper and lower bounds of these outcomes. These alternative scenarios are modeled on realistic assumptions that are somewhat more optimistic or pessimistic than the baseline. See page 20 for the General Fund revenue implications of these scenarios.

Optimistic Scenario – A Faster Recovery:

The dark winter proves less severe than feared. The economy quickly returns to health by early 2022, leading the overall cycle to more closely resemble the traditional recovery from a natural disaster. The likely underpinnings of this outlook include an acceleration in the vaccine supply in the months ahead, combined with a stronger federal policy response to improve the economy. The majority of households have additional financial firepower to spend as a result and the confidence they can do so safely. The number of firm closures and permanent layoffs are kept to a minimum, aiding the pace of recovery.

Pessimistic Scenario – A Double-Dip Recession:

The decline in new COVID cases proves a false dawn, likely due to a bungled vaccine distribution system, or new variants of the virus worsening the pandemic. The end result is consumers stay home to a greater degree and businesses once again face dropping revenues. Complicating matters is a divided federal government that does not pass additional aid quickly to support laid off workers and struggling households and firms. More permanent damage accumulates, slowing the overall recovery. Oregon’s economy does not fully return to health until late 2025.

1 https://sites.google.com/view/covid-rps/

The Full Report can be found at https://www.oregon.gov/das/oea/pages/forecastecorev.aspx

Those were indeed tough economic times. But still today, in 2022, I’m so worried about the US recession.