Lithia & Driveway (LAD) Increases Revenue 18%

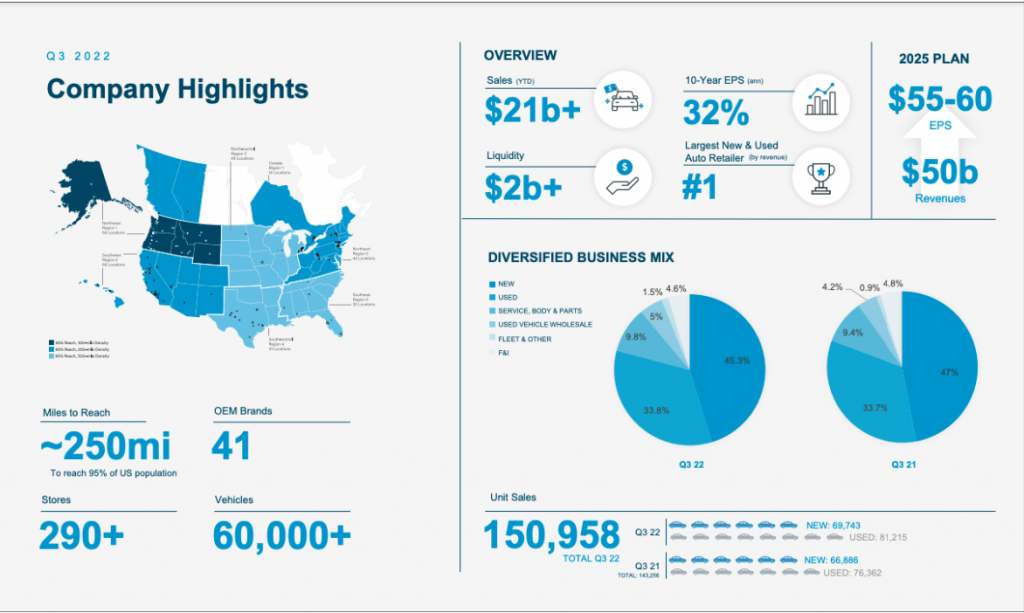

Lithia & Driveway (NYSE: LAD) reported the highest third quarter revenue and earnings per share in company history.

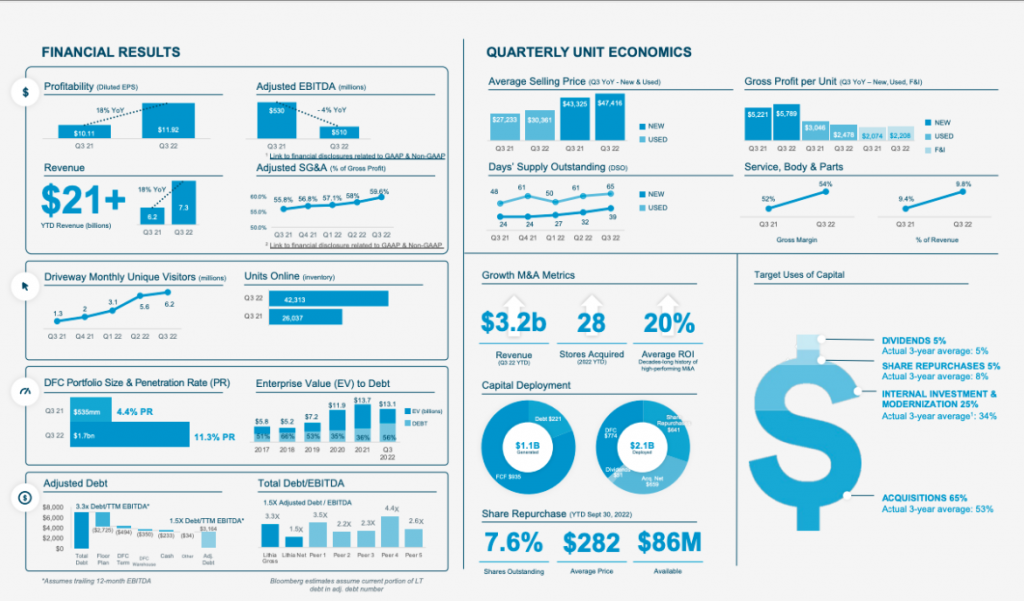

Third quarter 2022 revenue increased 18% to $7.3 billion from $6.2 billion in the third quarter of 2021.

Third quarter 2022 net income attributable to LAD per diluted share was $11.92, an 18% increase from $10.11 per diluted share reported in the third quarter of 2021. Adjusted third quarter 2022 net income attributable to LAD per diluted share was $11.08, a 1% decrease compared to $11.21 per diluted share in the same period of 2021. Foreign currency exchange negatively impacted earnings per share by $0.54.

Third quarter 2022 net income was $330 million, a 7% increase compared to net income of $309 million in the same period of 2021. Adjusted third quarter 2022 net income was $307 million, a 10% decrease compared to adjusted net income of $342 million for the same period of 2021.

As shown in the attached non-GAAP reconciliation tables, the 2022 third quarter adjusted results exclude an $0.84 per diluted share net non-core benefit related to a net gain on the sale of stores and a non-cash unrealized investment gain, partially offset by acquisition expenses. The 2021 third quarter adjusted results include a $1.10 per diluted share net non-core charge related to a non-cash unrealized investment loss, loss on redemption of senior notes, acquisition expenses, insurance reserves, and asset impairment.

Third Quarter-Over-Quarter Comparisons and 2022 Performance Highlights:

- Revenues increased 18.2%

- Gross profit increased 10.5%

- Vehicle gross profit per unit of $6,139, down $36

- Driveway averaged over 2 million monthly unique visitors in Q3

- Driveway transactions increase by 327%

- Driveway Finance penetration rate rose to over 11% in Q3

- Adjusted SG&A as a percentage of gross profit was 59.6%

“We posted strong results across our business lines this quarter, while navigating the current environment, integrating a steady stream of acquisitions and continuing to grow Driveway and Driveway Finance. Our teams are focused on improving operating leverage as fundamentals normalize across our industry,” said Bryan DeBoer, Lithia & Driveway, President and CEO. “With our size and scale, we are well positioned with financial flexibility and liquidity to continue delivering growth with strong returns as we progress toward achieving our 2025 plan.”

For the first nine months of 2022 revenues increased 29% to $21.2 billion, compared to $16.5 billion in 2021.

Net income attributable to LAD for the first nine months of 2022 was $35.10 per diluted share, compared to $26.91 per diluted share in 2021, an increase of 30%. Adjusted net income attributable to LAD per diluted share for the first nine months of 2022 increased 24% to $35.30 from $28.52 in the same period of 2021. Foreign currency exchange negatively impacted earnings per share by $0.65.

Corporate Development

During the third quarter, LAD acquired six locations, including five Wilde Automotive Group locations in Wisconsin, expanding presence in the North Central region, and Elk Grove Ford in Elk Grove, California. In October, LAD acquired six locations in the Pacific Northwest with Airstream Adventures. LAD has acquired over $3.0 billion in annualized revenues to date in 2022 and $13.3 billion in annualized revenues since the announcement of the 2025 Plan in July 2020.

Balance Sheet Update

LAD ended the third quarter with approximately $1.6 billion in cash and availability on our revolving lines of credit. In addition, unfinanced real estate could provide additional liquidity of approximately $0.4 billion.

Dividend Payment and Share Repurchases

The Board of Directors approved a dividend of $0.42 per share related to third quarter 2022 financial results. The dividend is expected to be paid on November 18, 2022 to shareholders of record on November 11, 2022.

In 2022, LAD repurchased approximately 2.3 million shares at a weighted average price of approximately $281. Under the current share repurchase authorization, approximately $77 remains available.

About Lithia & Driveway (LAD)

LAD is a growth company focused on profitably consolidating the largest retail sector in North America through providing personal transportation solutions wherever, whenever, and however consumers desire.

Sites

www.lithia.com

investors.lithiadriveway.com

www.lithiacareers.com

www.driveway.com

www.greencars.com

www.drivewayfinancecorp.com

Advertisement