Knowing Your Breakeven Point

In line with recent articles regarding various aspects of surviving inflationary and recessionary times, I’d like to discuss how a business can figure out how to react in these situations. Gaining intelligence and insights through reading articles or watching videos and acting on the advice, or initiating changes to your business operations based on ‘gut instincts’ can be a good thing to do, but can also lead to disaster if the strategies are not appropriate for the situation. If you are looking at uncertain upside returns and high probabilities for downside disaster, what are you to do? How are you going to make good decisions? Perhaps you have chosen option #3, which is to do nothing, hoping for a better outcome through this method. Unfortunately, this third option is rarely a good idea, as maintaining a ‘no-decision’ trajectory during deteriorating business conditions has been proven to cause failure.

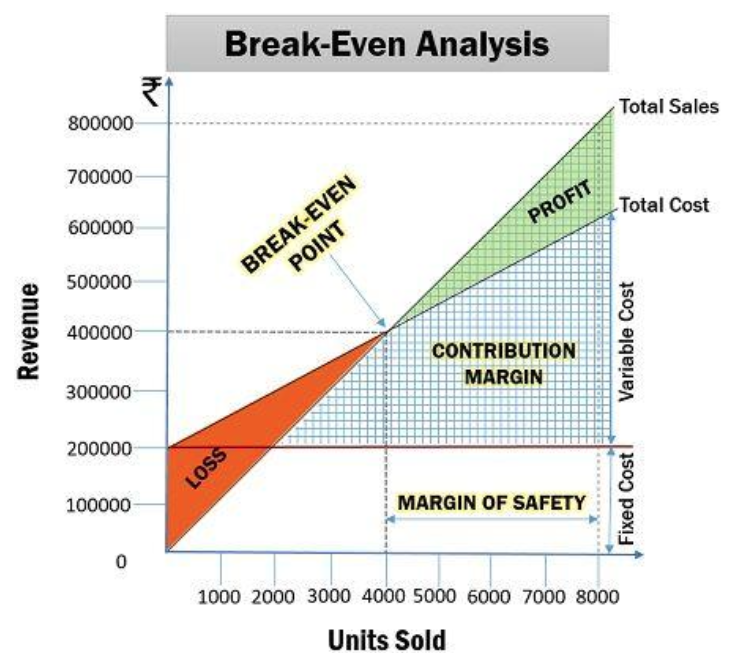

The first solution to this dilemma is to look for tools to measure and evaluate your business’s performance with. One such tool is to understand what breakeven points are and how to use them. As a primer, a person could say that April 18, 2023 (Tax Freedom Day 2023) is a breakeven point, as this is the day next year that the annual tax burden is fulfilled and that the tax cost for businesses has been satisfied through revenues produced, on average.

Coming closer to home, within a business breakeven points can be determined through simple means, depending on what is needing determination. For instance, many businesses want to know how much production, business operations, or units produced or sold need to happen in order to satisfy the firm’s fixed costs? The point at which the levels of operations produce sufficient revenues to satisfy the fixed cost burden is a breakeven point. In the figure on the right, this point is at the intersection of the lower angled (total sales) line at the bottom of the red triangle and the horizontal fixed-cost line, shown as a small yellow dot.

More importantly, to most businesses, the point marked ‘breakeven point’ on the diagram is the one most business owners want to know. At this point, all of the fixed costs and all of the variable costs involved in the manufacture and delivery of the good are satisfied through sales and the net is zero to the owner. From here on, the business starts earning profits while still covering all of the costs involved with the manufacture of the goods. Determining this break-even point is a powerful tool to use when you want to understand how your business is performing. Several considerations to think about when using this are:

- All of the relevant costs a business experiences are accounted for in the ‘Total Cost’ figures;

- Make sure the figures used accurate and are based solely on the business’s performance as reflected in the Income Statement;

- The more accurate the numbers are, the better use they are in determining product or service pricing, based on the company’s experience. This can be especially useful when price increases are being experienced for the production inputs that build finished products revenues;

- This model applies equally to service businesses, retailers and manufacturers;

- Once the breakeven point is reached, additional production and sales contribute directly to the bottom line profitability, making it possible to increase profits through discounting as a purposeful act and not as a reactionary response to market pressures;

- This model gives insights into aspects of cost accounting within a business to assist the decision-making process, moving that process away from exclusively using ‘gut-feelings’.

Most small business owners think it is important to keep good accounting records so that they can avoid tax problems, or to make sure they are good stewards of their employees needs. These are all important considerations. It is when the realization hits that the accounting information can be used to make accurate and timely decisions to manage the business to be productive and profitable, even in recessionary and inflationary times, that the real understanding of how powerful this information can be is achieved.

—-

Marshall Doak is the Director of the Southern Oregon University Small Business Development Center and a huge supporter of innovation and the community that forms around innovation in the economy. In private practice, he works with businesses that plan to transition to new ownership within the next five years, assisting them to build value that can be converted to retirement income when the business sells. He can be reached through: mdoak06@gmail.com or 541-646-4126.

Advertisement