Are the federal stimulus payments taxed in Oregon?

By Oregon Department of Revenue

The stimulus, officially called the Economic Impact Payments, are not taxed as income in Oregon. However, the payments may impact the federal tax calculations used on your Oregon income tax return.

Background

Oregon is one of six states that has a limited subtraction for federal taxes paid as part of its state income tax calculation. The maximum amount changes every year because it is indexed for inflation. For tax year 2020, Oregon income tax filers can subtract the first $6,950 ($3,475 for married filing separately) in federal taxes paid from the income on which they pay state income tax.

Economic Impact Payments and the Recovery Rebate Credit

When Congress created the Economic Impact Payments, they made them a prepayment of the 2020 federal Recovery Rebate Credit. Those payments were essentially a reduction of your 2020 federal taxes—received in advance.

What that means under current Oregon law

Under current Oregon law, taxpayers’ federal income tax subtraction will be reduced by the combined total of their Economic Impact Payments. This means some Oregon income tax filers may owe state tax on more of their income and, therefore, may have a larger Oregon income tax bill or a reduced refund.

Those who won’t be affected

Lower income taxpayers who do not have a federal tax liability will not be affected.

Taxpayers whose federal income tax paid—after subtracting the total of their Economic

Impact Payments—is greater than $6,950 ($3,475 for married filing separately) will also not be affected.

It also won’t affect those who didn’t receive Economic Impact Payments or won’t

receive the Recovery Rebate Credit as determined by the IRS.

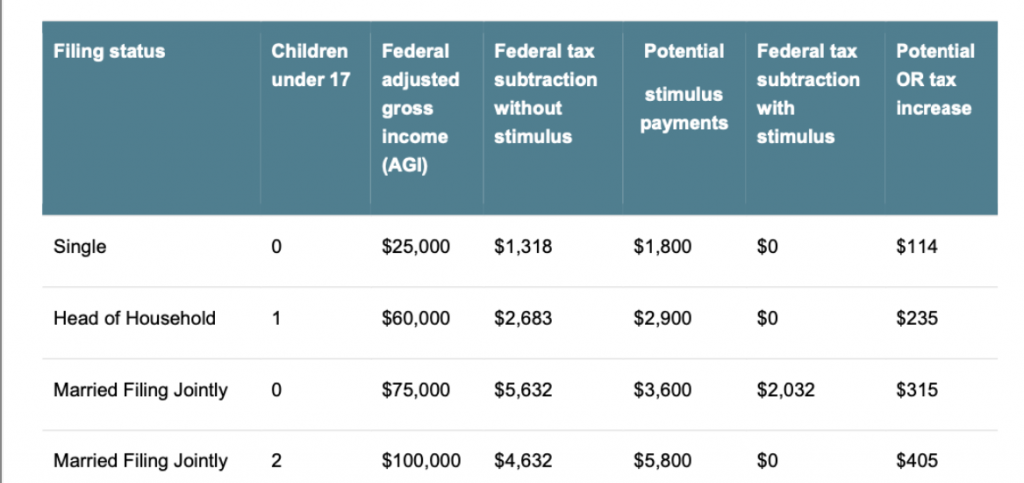

Below is a table that shows the effect of the stimulus payments in the calculation of the

Oregon federal tax subtraction in four different situations. For more, see our detailed examples.

Additional resources:

Internal Revenue Service

www.irs.gov

Oregon Department of Revenue

www.oregon.gov/dor

503-378-4988 or 800-356-4222

questions.dor@oregon.gov

Advertisement