ALL IN – A Masterclass on Leadership from Gene Pelham as he retires as CEO of Rogue Credit Union

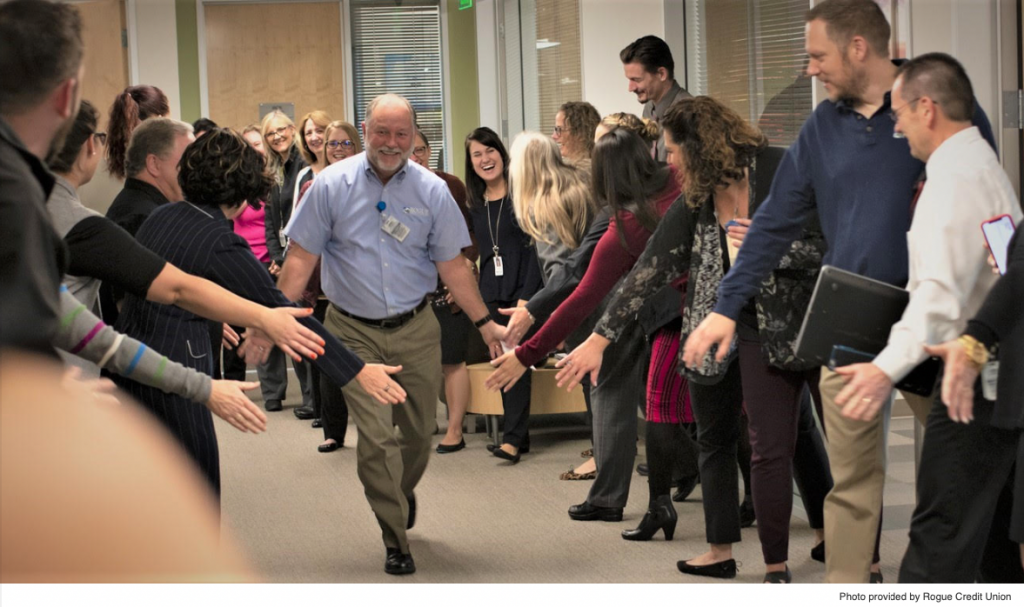

I have known Gene Pelham for many years and when he announced last year that he was retiring on March 31, 2022 as CEO of Rogue Credit Union, I reached out to him for a quick interview over zoom. I thought this was going to be a simple story about a business leader retiring and that was that. What I realized as I went through the interview and as I read my notes and listened over and over again to the recording was that this is something more and I needed to figure out when to share it. When I was invited to his retirement party, put on by the credit union, and after the final farewell and thank you was said, I knew it was time to share this story.

Southern Oregon is built on leadership born and raised here.

I see it time and time again. I’m hoping Gene’s story is a reminder that local leaders are what built our community. You can be born and raised in Southern Oregon and be a world class leader that grows an organization to its fullest potential and be a community minded leader that serves on local boards and make wider and deeper differences every day. This is true with Gene Pelham as well as Ken Trautman, Sid DeBoer, Jim Wright and so many amazing leaders in Southern Oregon that I have had the honor to know and serve with over the years.

Gene’s Story

“In high school, the last thing I had ever imagined was working in financial services.”

Gene Pelham graduated from Eagle Point High School in 1978. He didn’t think he would be able to go to college. His dad was a truck driver in the lumber industry. He wanted to be a baseball coach and history teacher but he thought that college wasn’t in his future due to cost. But a high school guidance councilor reached out to him and told him to fill out a form for a US Bank Scholarship. Back then US Bank was an Oregon Bank and they had a program where 20 students a year were paid full tuition scholarships to go to college, get a degree and then go to work for the bank.

He graduated from college and worked for them until 1985. “I came out after five years with my degree, and two years of experience at the bank with everything from from being a really bad drive up teller, to a not so bad commercial lender.”

“The only reason I left the bank was because I didn’t want to move to Portland to advance my career. I went to Rogue Federal Credit Union and applied and had a great interview but they didn’t hire me because I worked for a bank. There has always been this yin and yang thing about credit unions and banks. So I went to work for another credit union and in 9 months got transferred to Eugene/Springfield and spent 18 years there.“

During the time he spent in Eugene/Springfield, the man that interviewed him at Rogue, and didn’t hire him was Tim Alford. Tim became CEO of Rogue and kept an eye on Gene and watched how his career progressed. When Tim was ready to retire, he called Gene and said “Would you like to come back home?” Gene had worked his way up to CEO of a smaller credit union in Eugene/Springfield that had just merged with a much larger Credit Union and he was about to be sent to Portland to work there. That’s when Tim called and offered Gene the job back in the valley. The timing was perfect.

“I grew up in a town of 1,500 people, raised my kids in a town of 2,000 people and I didn’t want to live in a major metropolitan area.”

He jokes with staff all the time, about how it may of taken them a month or two or six to get a job at Rogue but it took Gene 18 years.

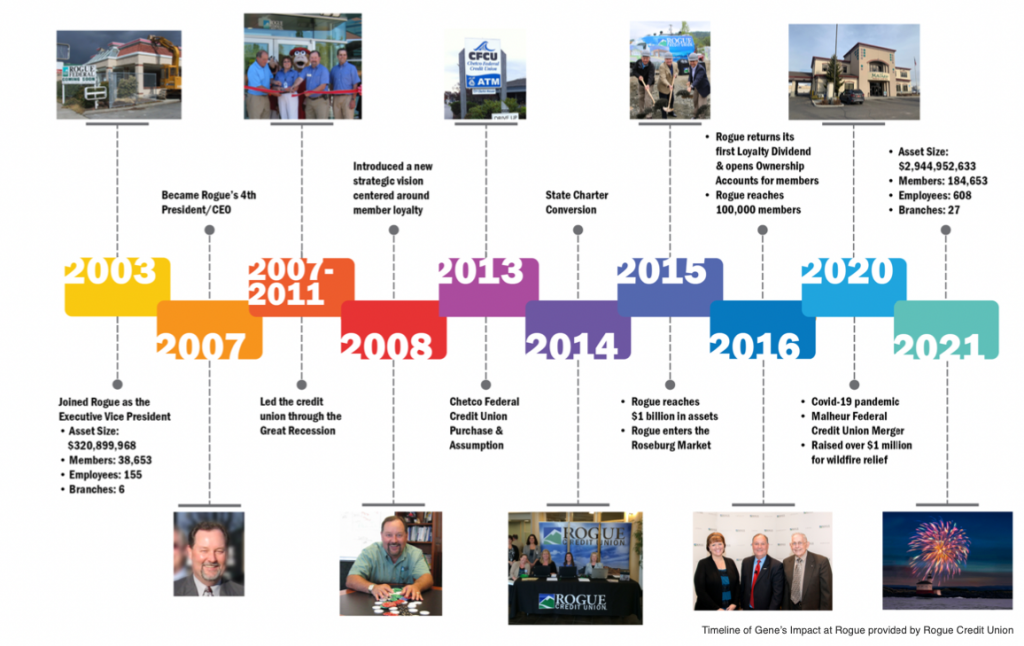

He came back to the valley in 2003 and became CEO in 2007.

When he took over, they were about $360 million in assets with 3 full service branches and 2 partial service branches and now they are nearly $3 billion in assets with 27 branches.

The credit union was founded by Jim Johnston and a handful of teachers and it was run out of Jim’s home on New Town Street in Medford for a few years. It started in his living room and a little alcove in his house and grew from there.

Gene became the 4th CEO of the Credit Union and it happened to be during the start of the Great Recession. He used the year to identify the strategy they wanted to focus on, built consensus with his board and the teams and introduced it to his staff in early 2008.

The strategy was simple. Gene wanted the Credit Union to create an experience where people wanted to come do business with them and tell others about how great it is to do business with them. He wanted to create an experience like Costco and USAA was doing.

“Our strategy was to create the most loyal members in the nation.” Not just of Credit Unions, but the most loyal members of any organization.

The result of the strategic shift was that 90% of all new members that joined the Credit Union were referred by somebody else, a friend, family member, or co worker.

“Growth has been a result, not a strategy of the credit union.”

Gene’s vision was to be an organization that was good to be loyal to, not only from a member perspective but from a staff perspective as well. When they did their initial surveys they realized they were not an organization to be loyal to. “We had member rewards that were anything but rewarding” They rewarded members only if they did business the way the Credit Union wanted them to, not the way they wanted to do business with the Credit Union. He even has seen comments eight years after stopping the old way and some members were still upset about it.

They adopted the new strategy in April 2008 during the world financial crisis.

Gene credits his board for trusting him to build long-term loyalty and taking care of the members when times were tough. “We let people keep cars longer than they should have.”

“Other local well respected institutions were struggling, being acquired by other institutions and peoples accounts were changed.”

“We were there along with People’s Bank when folks needed it most. I look at our two organizations since that time. We created this incredible connection with folks that they do business with, even if it’s not the most economically beneficial to them but it is emotionally beneficial to them.”

“People still buy and choose based on how they feel and what the emotions are and whether they can trust and we’re in institutions that create trust. That’s why we have the largest market share of consumer auto lending.”

“We have the largest market share in deposits in the markets that we serve and our deposit rates are lower and our loan rates are higher.”

“That’s why I say, growth was never a strategy. Growth was a result of just focusing on trying to do the right thing, and creating an organization people could trust. And that’s what has been the foundation of everything that we’ve done.”

I asked Gene what it was like to announce his retirement and pick his successor. He reminded me that it took him 18 years to get the job at Rogue and he is confident that the first person he hired when he became CEO 18 years ago, Matt Stephenson, has been groomed since coming on board. Gene negotiated his final contract 5 years ago, knowing this day would come and has spent the last 5 years making sure that his replacement would be able to take over without missing a beat.

Gene told me that he is running Rogue 4.0 and that Matt will be running Rogue 5.0. The next version of the credit Union will compete in a completely different economic and technological environment and it will need a different skill set to engage and excite members and staff. He also shared with me that it became difficult for him to remember the names and faces of everyone when the credit union grew to 300 employees, it now has over 600.

“He’s been my executive vice president for several years, working very closely, and actually running the majority of the day to day operations for a while, which has allowed me to be involved in the community and have the opportunity to influence staff more directly. It was a process that was a plan and I’ve been working with the board specifically, since 2017, to make sure that we execute the plan.”

When I asked Gene about the next generation of members and their expectations to banking digitally he dropped deeper into Professor Gene mode and walked me through the process that the Credit Union went through to test the readiness of it’s members to do banking fully online. This is brilliant stuff and he could easily do a 10 week master class on this. As you read it, he focuses on his experiences with members in a financial institution but really it will apply to all industries.

“We started talking about ‘Figital’ a long time ago”

‘Figital’ is a buzzword used in the banking industry to explain a concept of making the digital experience similar to the physical experience. For 20 years Gene and his team have been watching industry trends and expected that members would expect to do more banking digitally than in person so they experimented. They opened a cashless branch with ATMS in the lobby and folks to help make loans in the early 2000’s and it wasn’t a success. They quickly saw that their members were not ready for that. In fact tellers were going to the ATM and taking cash out out of their own account and giving it to the customer, just to satisfy the customer expectation. They realized their members wanted to come into the branch and work with a teller instead of a machine.

Then they added a full service ATM in the lobby of busy branches because the lines to talk to the teller were long but no one would step out of line to use it, so they pulled it out.

“Every time we think that people won’t use branches again, they surprise us”

The Central Point branch doubled in physical size in 2018 and it was overwhelmed in a years time by the volume of business.

But there are changes. They are noticing that the average number of transactions per member in a branch are decreasing very, very slightly, and the overall number of transactions a member is doing is increasing exponentially. They are utilizing “Express Teller Machines” where you can drive up and deal with a live person via video from 7am to 7pm.

Gene goes on to explain that the big banks are ‘reading their own press releases’ about customers not wanting to do business in a branch anymore and when they close a branch, it floods the credit union nearby with new members.

“What we’ve seen is that more and more financial institutions push people away from the personal delivery options.”

“Now the big problem with that so many credit unions are still trying to be the low cost leader or the low price leader in what they do. And that’s a recipe for failure immediately. If you’re trying to provide all this personalized service and not getting a fair return for it you fail. So that’s that’s why our deposit rates are better than most but not the best, and our loan rates are better than most, but not the best.”

“Our members are willing to pay for the service.”

“We also just invested $8 million to upgrade our data systems to make them more plug and play with all the new things coming on as we go forward. We’re exploring relationships with a variety of fintechs that can do things better than we have. Our technology group went from having four guys when Matt started to 40 plus folks in our technology department now, with everything from development to infrastructure to service type things.”

“We’re trying to be prepared. I liken it to kind of being on the balls of your feet, able to move whichever way the markets do. I’ve seen so many institutions kind of pigeonhole themselves into either a full technology strategy or a full physical strategy. And, that’s not the way people are doing business today. Why is Walmart still open? It’s because people still want a physical experience. Why did Amazon buy whole foods? They looked for that physical outlet.”

“Fortunately, people want to do business in person. And they’re willing to pay for it. But at the same point, they want to do business in person when it’s convenient for them, but they also want their app to work and they want somebody to answer the phone and they want the Express teller machine to be available. So it is incredibly challenging”

“We’re trying to take and bottle up the incredible physical experience and make sure that’s felt digitally. Because we believe that there still is an opportunity to create loyalty, even through the physical and the digital experience.”

“And we’re also seeing so many folks say the millennials will only use technology. That’s not what we’re seeing when you come stand in our lobbies.”

“One of the things that folks fail to realize is what have Millennials grown up with. They’ve grown up with their parents being there, to provide advice and all the other things. And so while they don’t want to go to their parents, they’re used to seeking the advice and input of others before they make decisions. And we’re that trusted source for them. They’ll sit in our lobbies, in our offices with our member service representatives, because they need some kind of assurance before they move forward. I think that’s being lost in all the white papers, and all the research that’s going on out there. Millennials still need that confirmation. And yes, they get it from each other. But who did they get it from for the most formative years of their life, an older, more wiser person. And so they see our MSRs even though they’re one or two years older, as being an older, wiser advisor to help them make important financial decisions such as buying their first car, buying their first home, or saving for their retirement.”

I let Gene catch his breath and asked him about how they grew so fast and if they were challenged by being able to find good employees.

“During the financial crisis, Chetco Federal Credit Union, on the coast, failed and they were being run by our regulator/insurer. We did a full court press because we knew that if they went to another credit union, it would have a significant impact on our ability to be strong in this market. We won the bid for them and because we bid that so well, and we built such a good case on that acquisition purchasing assumption, the loans performed much better through our leadership and guidance in creating loyalty with those folks. The loans performed much better than the regulator’s thought they would.”

“There’s no way to create additional net worth unless you create additional income, and we would never have been able to grow at the rate we were able to grow, over the last several years, without buying that credit union, and getting those loans to perform exceptionally well.”

“I was contacted by a credit union in Ontario, Oregon, they had lost their CEO, and they were putting out a request for proposal from merchant partners. This was just as COVID was starting to take place. They begged us to put in a request for proposal, and so we did. And of course, they chose us as the credit union that they wanted to business with, because of what we stood for and our focus on rural communities. “

“Which gave us not only a presence in Eastern Oregon, but Western Idaho, so now we have branches in Oregon and Idaho, and the ability to serve Northern California. So we’re we’re spreading quite a bit from little Medford, Oregon, but it’s the reality. Like I said, we invested $8 million in technology. You have to be this size to be able to afford the technology that consumers demand today.”

“The incredible success and the support of Southern Oregon that we’ve seen has resulted in the fact that we’re employing more and more and more people here in Southern Oregon and we were out of room.”

“Everybody thought that people spent their COVID relief money. No, they saved their money. And so we grew from March of 2020 to March of 2021 from $1 billion in assets and now we’re at $2.8.”

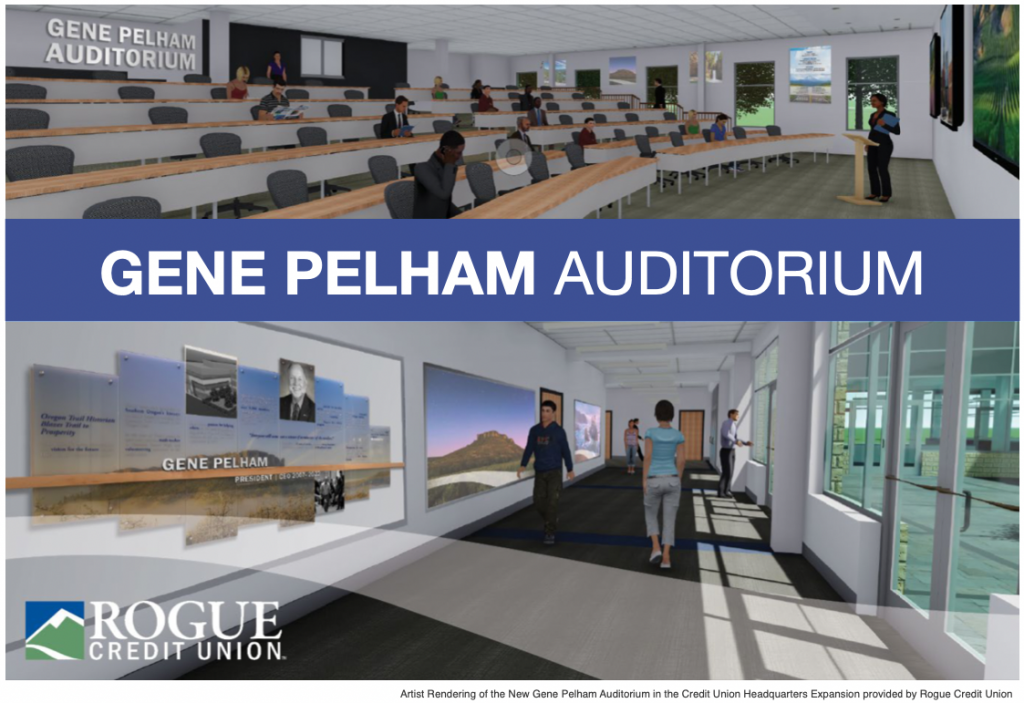

I asked Gene about the massive construction project across the street from their headquarters and what the plan is to fill the space.

“Now, we’re in the throes of all organizational kind of upheaval, in creating systems and processes and an ability to serve larger groups and one of the results of that is staff members. We were already seeing that and thought about building this new building, prior to that massive growth. But when we built the building out at 30,000 feet, in 2016, we thought that would last us five to seven years. Within two to three years, we’re already filling closets back up and shrinking down cubicles. So we tried to be a little bit more progressive in our thinking on this new building. And we thought we were going to maybe take advantage of the downturn, and lower construction costs and all the things that go with it. And then that didn’t happen. Everything else happened and the construction in the Rogue Valley just exploded. “

“We hope to have well over 200 people in this new building and will have an auditorium for us because we believe bringing people together is still important. We will also have a mock branch for training, so staff members can actually work in an actual branch.”

Rogue also has a 16,000 SQFT building that houses their call center which is where the live tellers work for all the video ATMs.

To wrap up the interview I asked Gene about growing up in Eagle Point.

“My dad was a log truck driver and worked in the mills and my mom worked in retail. Eagle Point was a great place for me to be raised. I got a chance to play a variety of sports, whether it was baseball, football, or even run track. My coaches were great examples and mentors for me. I found out that I never was the best athlete, but man I was a great teammate.”

“It’s just one of the things I’ve kind of figured out. I wasn’t always the best practitioner, but I helped others be better. I was fortunate… my junior year, we played for the baseball state championship and lost it by one game. But my senior year, we won the state championship in baseball. All of those things kind of gave me the leg up on the US Bank scholarship. It was those abilities to be part of successful teams. That’s been kind of a foundation for me, for everything I’ve done. Finding a way to help teams and individuals realize their full potential and even if you don’t have a bunch of superstars, if you have everybody on the team, realizing their full potential, you’ll be superstars every day. That’s probably one of the greatest things I’m proud of. It’s the various teams that I’ve been on or coached and how we over achieved in each of those times. It was fun to see people realize that they can have success.“

“My wife and I celebrated our 43rd wedding anniversary in September. We were high-school sweethearts. She was the scorekeeper on our state championship baseball team. We’ve kind of traveled this journey together. She was a hairdresser, and ran her own business for several years. And now she’s retired because things have gotten so crazy busy for me, just to kind of help us stay on top of things here.“

“Because being the CEO is not a part time job or full time job. It is an all the time job.“

“What I plan to do in the future is slow down a little bit. I hope to be able to help smaller credit unions and non-profits.”

“We will relocate most of the time to south of Eugene, because I was in Eugene, for 18 years. My kids were raised there. That’s their home. That’s where my son is raising his family. One of the reasons I chose to retire at 62 instead of later, is if I retired at 65, my grandson would be right at the point of graduating from high school, and I would never really have had the opportunity to be an active part of his life. And so that’s what I’m choosing to do.”

Gene also bragged about his daughters dog “lucyloo_cavapoo” with over 9 million views on TikTok.

“We focused on teams from the very beginning. Building a sense of team with our board. I’ve got an incredible board of directors of local community people that are incredibly bright, and also able to see my vision, challenge my vision, and help me build the vision as we go forward.”

“I would say to a CEO or a leader, build the right kind of relationship with your board, because it’s a trusting relationship.”

“If you create a positive experience for the member, and staff members are not asked to just sell the product of the day, they’re asked to truly help people in a way that creates loyalty, and in a way that staff feel really good about… if we do those two things, then we’re going to make enough money to be successful, and if we do that well enough, then we’re able to spin that off and share that with the community. “

“That’s the thing I’m proudest of. Our board and our staff members have joined together with a belief of what we’re trying to do is for us to be able to have a significant impact on the communities that we serve.”

Our hour long zoom interview was over and my head was spinning. Gene the “history teacher” dropped hundreds of gems about his leadership philosophy and his history. Many of which I’m sharing with you today and some I will save for future articles. In the days, weeks and months since our interview Gene shared more wisdom with me, as it came to him or as I asked followup questions.

Yes he is a great CEO who went “All In” on expanding an organization with the simple strategy based on creating the most loyal members in the nation but he is also a great teacher, mentor and community leader and I can’t wait to learn from him during the next chapter of his life.

Congratulations Gene. Enjoy retirement.

—-

Gene’s Favorite Leadership Books :

(I'm linking them to Amazon to make it easy. I do not make a commission on these links - Jim)

Steven Covey’s 7 Habits of Highly Effective People

Kouznes and Pousner’s The Leadership Challenge and one of their follow ups Encourage the Heart

Leadership and Self-Deception by the Arbinger Institute

5 Dysfunctions of a Team are great tools I use to build effective leaders and teams. In addition, anything by John Maxwell is always a go to…

—

In March 2022, Gene was inducted into the Credit Union House Hall of Leaders

Gene is only the fourth person from Oregon since 2008, the year the recognition began.

Rogue Credit Union – https://www.roguecu.org/

Advertisement