Accessing Capital for Business Survival

By Marshall Doak Director, Southern Oregon University SBDC OSBDCN Market Research Institute doakm@sou.edu

Obtaining adequate capital investments to grow a business is a huge issue, something all businesses have in common whether they be in a startup phase or have been in existence for many years. It can seem remarkable to many businesses that in a world awash in money that actually getting a little of it to fund startup or expansion costs is so hard to obtain. In fact, starting this article with a statement regarding putting money into a business seems counterintuitive to the desire to pull money out of a company. Increasing your personal wealth is a reason you are in business anyway, right? Let’s look at some dynamics in play to try and explain some early and mid-stage reasons why money flows in the opposite direction from what is desired.

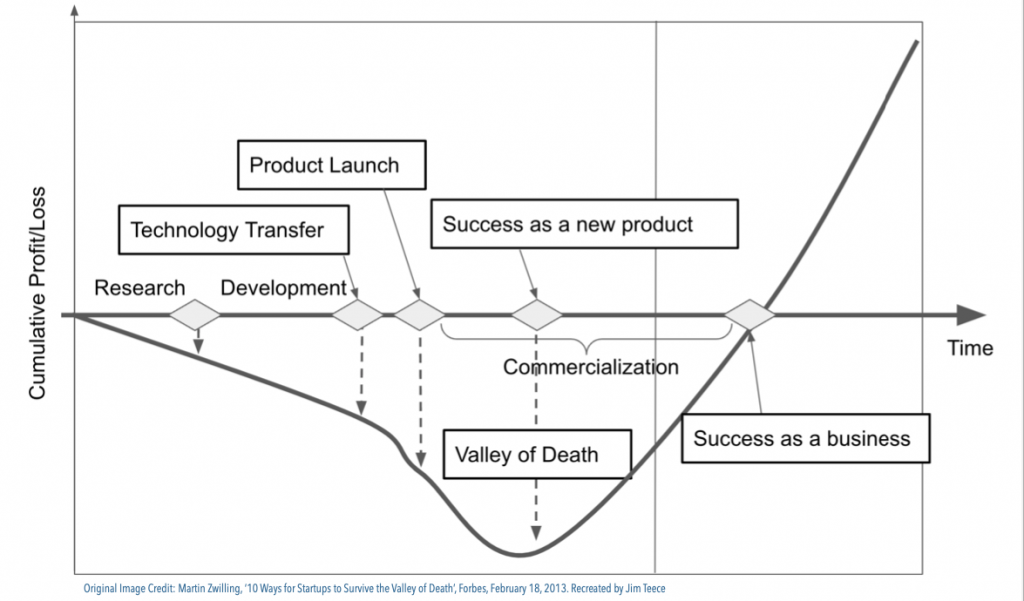

The diagram above is a representation of what is commonly called ‘The Valley of Death’ for startup and young businesses. The important elements are as time progresses (center horizontal line) from an initial start, cumulative profits (dark curved line) are negative for a period of time until sustained revenues are realized at a level that supports business operations and generates additional capital above this level.

Many business failures reside within this ‘Valley of Death’. In the popular press, some authors show multiple ‘Valleys of Death’ as successive growth spurts consume additional capital with each growth phase. Understanding that capital access and continuing need for available cash through investments into the business and cash flow generation is critical to understanding the dynamics successful businesses need to overcome in order to remain competitive or viable.

I’ve found this valley to be a point of transition for businesses from initial sources of capital infusion to capital access from successive providers. Oftentimes, the transition goes from equity, or ownership contributions, to debt or financing with loans. It is critical to know that in all cases, knowing your needs, capabilities, and reasons for asking for money determines your success in attracting it. Mistaking the fact that thinking capital acquisition is an end point and not the tool for continuous use throughout the business life cycle that it actually is, can be a primary cause of business failure. There are no ‘one-shot’ needs for capital if your business will be anything more than stagnant prior to failure.

If there is any truth to the statement regarding a constant need for capital (money) for your business, then it makes sense to put yourself into position to be successful in attracting investment capital, working capital and savings from excess earnings. If you are at a level in your business where surplus earnings are not realized and your costs exceed your current earnings, knowing how you are going to correct this is fundamental to being able to achieve it. You will not be successful building your company (volume) and lose money on each transaction. This scenario only accelerates your demise. Better plans are needed than repeating a failed model.

If you are at the point where you are transitioning away from investor capital in exchange for ownership shares, then you are entering a new phase in your business’s development by borrowing money. If you borrow money, you have to pay it back along with the costs involved with renting the money. When you borrow money, you are working with an institution or individual who is betting on the fact that they will be repaid, so that makes them careful with the amount of risk they will accept. This highlights the fact that you, as entrepreneur, are bearing the full risk for your company’s ability to make good on the promises being made. In addition, you are making personal guarantees to repay the borrowed capital along the terms of the agreement you signed should your company fail to be able to perform to the expectations and promises made.

When you look for capital to borrow, there are many sources of capital that can be available, depending on the circumstances. Amounts, costs of borrowing, repayment terms, the commitment of collateral, the assessment of your character regarding the dedication to repay along with your capability to manage the intricacies of your company all come into play. The company’s demonstration of the ability to repay the loans being offered is critical to the success of the loan commitment being made to the entrepreneur. Failure to make the case for having adequate investment, collateral and ability to repay are the top three issues needing to be answered in a really solid manner to build confidence in the lender’s mind. The closer you are to having the Small Business Administration back the loan and the closer you are to using commercial banking for your loan source, the closer you are to needing a formal business plan and great pro-forma financial projections demonstrating the ability to repay and making the case for your ability to pull-off the representations made in the plan. The further you are from having an earnings history in many cases means the further you are from obtaining the funding you desire.

When you are looking for money from the commercial banking system, you are asking trained professionals who, in all probability, know more about your business than you do. Once they look over your current financial statements, it is certain they will know more about your company’s ability to perform on the loan than you will. Your best defense when working with informed investors or members of the banking community is to be ready to meet their objections to lending you the needed capital. How do you do this?

Start by understanding the ‘7 C’s of Credit’. You can find this through a search on the internet.

If you have truly gone past asking for money based on your hopes and projections, personality and character, assumed market share and development time projections, it is time to start building solid plans. It will take more than a PowerPoint presentation to convince lenders to put their capital in your hands.

Recognize the time and resources you dedicate to this phase of capital acquisition is well-spent, but also know this is not a fast process. Building a portfolio of documentation and documents is time consuming, but once completed, is easily updated over time for continued use.

Build your financial projections with care. They will be scrutinized and expect your assumptions to be challenged. The best defense here is to list your assumptions alongside the numbers you present on your projections, so the reader can understand what the projections are actually based on. Once challenged, be prepared to show the documentation of the projections to keep the assumptions from being changed. Your credibility is at stake.

Write your narrative not only to convince the reader of the quality of your company, but to demonstrate your understanding of the intricacies of management and control over the elements of your company. Build confidence on the readers part that you can handle what you are building, whatever form it takes or whomever you hire or whatever skill you are delegating.

Don’t wait until you need money to talk to lenders!!! You are not asking for just a loan, rather you are asking to build a long-term relationship with a source of stability for your operations, so approach the acquisition of capital as you would approach a great dating prospect. If you are not sure what that means, we will be happy to refer you to someone who can coach you, as our organization only advises businesses on business operations.

Finally, how deeply vested are you in your company? Are you ‘all-in’, or are you wanting other people to fund your business and take the risk? The answer to this question may determine if you are an attractive investment from an investor’s perspective.

In summary, obtaining sustainable financing for business growth is not a one-time action. There is a ‘Valley of Death’ for businesses to fall into and not reemerge, with some authors making the case that at regular intervals as businesses grow, other valleys are encountered that also can take a business down. Business capital can come from many sources, both internal and external. As time goes on, and especially when the type of capital sought changes from initial investor ownership structure to borrowed capital, the dynamics involved with acquiring capital change. The need to provide quality plans, demonstrate competence in managing organizations, and the deep understanding of why you are asking for money, how much you need and how it will be spent and repaid is fundamental to success in obtaining it. Behind every ask for capital, there needs to be a solid set of reasons for a third-party to lend some to you. Especially if you are asking professional investors/lenders for capital, as they know your business better than you do in many ways. It is up to you to prepare to talk with them on an even basis, which means you need to prepare personally as you prepare your company to represent itself in the best possible manner. This takes time and effort, but once done, helps a business perform and create wealth every day with much less effort than it did previous to the improvements.

The best possible manner for you to engage in building the critical elements of business structure and management into your operations is through our Small Business Management class. This has just started, and will finish in June 2022. There is still a small window open for you to join and catch-up with the cohort build your business to be able to participate in the capital markets. That small window will be shut in the very near future, so act now to join.

Advertisement